Alphaland: Creating more than $1.5 billion of value since 2009

This issue profiles an exceptional business in Asia that has a solid track record, a flawless balance sheet, demonstrated sustainable competitive advantages, and has been compounding significant value for its investors, members, and shareholders over time, regardless of the global market environment.

An exceptional business

Alphaland Corporation is a luxury property developer, based in the Philippines. It is a distinctive company, recognized for its uniqueness and superior quality. It has highly differentiated offerings and services for its high net worth market niches.

It operates the following distinctive projects and businesses:

Balesin Island Club, a private island paradise for members.

Aegle Wellness Center, a state-of-the-art wellness center with bespoke programs.

Alphaland Baguio Mountain Lodges, a master planned development of 300 lodge-style log homes and quadruplexes in the northern mountains.

The Residences at Alphaland Makati Place, a premier luxury condominium in the central business district.

Alphaland Makati Place, a multipurpose complex.

The Alpha Suites, a luxury serviced residences hotel, consistently ranked #1 by TripAdvisor.

The City Club, a hub for leisure, wellness, and business in the central business district.

Alphaland Corporate Tower, a 34-story, Grade AAA office building.

Alphaland Aviation, an aircraft charter and solutions provider.

Top of the Alpha, a premier entertainment space.

Balesin International Gateway, a 732 hectare master planned project in development on an island close to Balesin Island Club, which will feature the Alpha Beach Club (opening in 2022), 5 luxury hotels, 1,834 residences, an international airport, an 18-hole championship golf course, and a commercial village.

Earnings are generated primarily from sales of Alphaland Baguio Mountain Lodges homes and Balesin Island Club private villas; from leasing operations of Alphaland Makati Place and Alphaland Corporate Tower; and from operations of serviced residences of The Alpha Suites.

Earnings are also generated from sales of membership shares and operations of Balesin Island Club and The City Club, and from operations of Aegle Wellness Center and Alphaland Aviation.

Earnings performance

How have Alphaland’s comprehensive earnings performed over time?

2009: ₱74m

2010: ₱1,251m, +1,591%

2011: ₱7,711m, +516%

2012: ₱11,181m, +45%

2013: ₱11,301m, +1%

2014: ₱5,501m, -51% (Affected but liberated from private equity investor)

2015: ₱7,167m, +30%

2016: ₱7,703m, +8%

2017: ₱8,056m, +5%

2018: ₱8,727m, +8%

2019: ₱10,690m, +23% (Paid off all debt)

2020: ₱1,572m, -85% (Affected by Covid lockdown)

2021: ₱4,510m, +187% (Recovering from Covid lockdown)

Average annual earnings growth rate since 2009: +41%

The annual earnings growth rate is above 20%. Earnings grew 5,995% from ₱74 million in 2009 to ₱4.5 billion in 2021, or 41% per year, over the past 12 years. An annual earnings growth rate of 20% or more is considered significant.

The annual earnings growth rate exceeds the low risk savings rate, plus a premium, to keep pace with and above inflation. The earnings growth rate of 41% per year is greater than the 5-year average Philippine long term government bond rate of 5%.

Last year’s earnings growth rate is accelerating. Earnings grew 187% from ₱1.6 billion in 2020 to ₱4.5 billion in 2021, and exceeded its earnings decline of 85% in 2020, which was caused by the Covid lockdown.

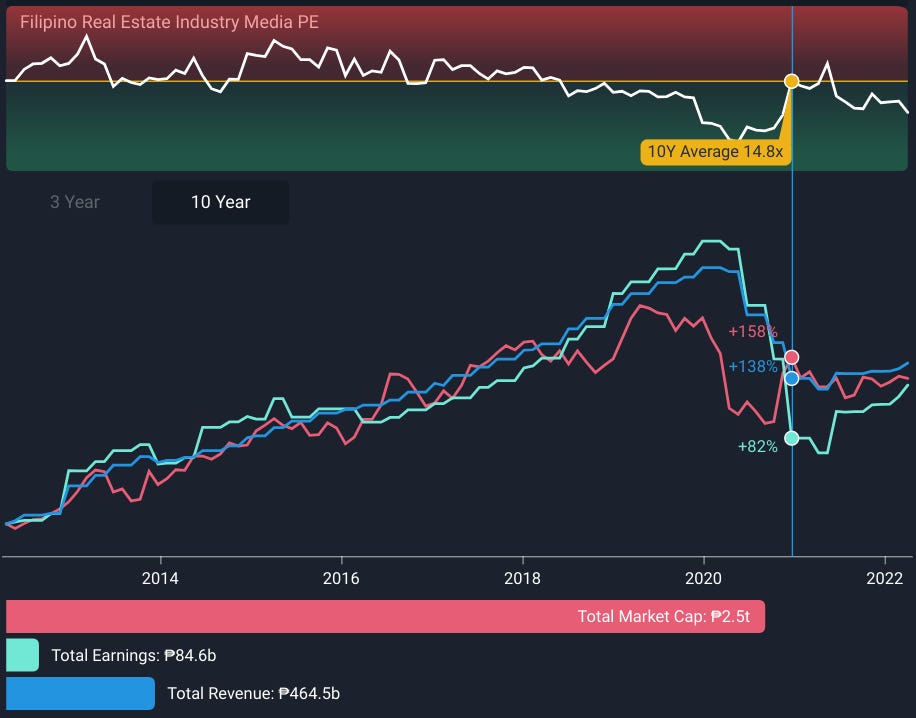

The chart below shows that the total earnings of Alphaland’s competitors in the industry fell 51% from ₱171.8 billion in 2019 to ₱84.6 billion in 2020 because of the lockdown.

As the economy slowly reopened in 2021, competitors’ total earnings grew 18% from ₱84.6 billion in 2020 to ₱99.6 billion, but is still below pre-pandemic levels.

Alphaland benefited greatly from the reopening of the economy and performed better.

Last year’s earnings growth rate exceeded the competition and market. Earnings growth of 187% over the prior year exceeded the industry’s earnings growth of 18% and the entire Philippine market’s earnings growth of 28%.

Value performance

How has Alphaland’s net worth or value performed over time?

2009: ₱9,991m

2010: ₱13,335m, +34%

2011: ₱24,338m, +83%

2012: ₱35,524m, +46%

2013: ₱46,826m, +32%

2014: ₱37,552m, -20% (Affected but liberated from private equity investor)

2015: ₱44,719m, +19%

2016: ₱52,412m, +17%

2017: ₱60,416m, +15%

2018: ₱70,070m, +16%

2019: ₱80,830m, +15% (Paid off all debt)

2020: ₱81,991m, +1% (Affected by Covid lockdown)

2021: ₱86,059m, +5% (Recovering from Covid lockdown)

Average annual net worth growth rate since 2009: +20%

A total of ₱76 billion or $1.5 billion of shareholder value was created. Net worth grew 761% from ₱10 billion in 2009 to ₱86 billion in 2021, or 20% per year, over the past 12 years. An annual net worth growth rate of 20% or more is considered significant.

The annual net worth growth rate exceeded the market. Net worth growth of 20% per year exceeded the MSCI Philippine Stock Index’s growth of 6.9% per year.

In other words, ₱10,000 invested in Alphaland in 2009 was worth about ₱86,000 at the end of 2021, while ₱10,000 invested in the MSCI Philippine Stock Index was only worth ₱22,346.

Alphaland doubled shareholder wealth every 3.6 years.

Financial health

How is Alphaland’s financial position?

Alphaland is financially healthy. It hasn’t had any debt since 2019. It has a cash pile of ₱1.2 billion and its short term assets of ₱12.9 billion adequately cover its short term liabilities of ₱6.5 billion.

Alphaland’s true value

What is Alphaland’s true value? How does it compare to its current net worth?

A business’ true or intrinsic value is an estimate today of how much earnings and cash it will make in the future. A discounted cash flow valuation model is used to determine its true value and whether the business is fairly valued, overvalued, or undervalued. This is the only true way to value a business and is used by analysts from the world’s most reputable brokers, institutions, and research firms, and by the top investing minds over the ages.

Without getting into the calculation, the results are:

Alphaland’s true or intrinsic value is estimated to be ₱145 billion or $2.8 billion.

Alphaland’s current net worth of ₱86.1 billion is 41% below its true value. This means that, based on how much earnings and cash it will make in the future, Alphaland’s value and the value of its offerings have more upside potential than downside risk.

The author does not receive any compensation and does not own shares of Alphaland Corporation. He enjoys analyzing and estimating the true or intrinsic value of businesses.

This post is excerpted, edited, and sourced from Alphaland’s 2009 to 2021 annual reports, company filings, and S&P Global Market Intelligence. The content is for general informational and entertainment purposes only and should not be construed as investment advice.