An amazing thing happened when Lehman Brothers collapsed and global financial markets plunged...

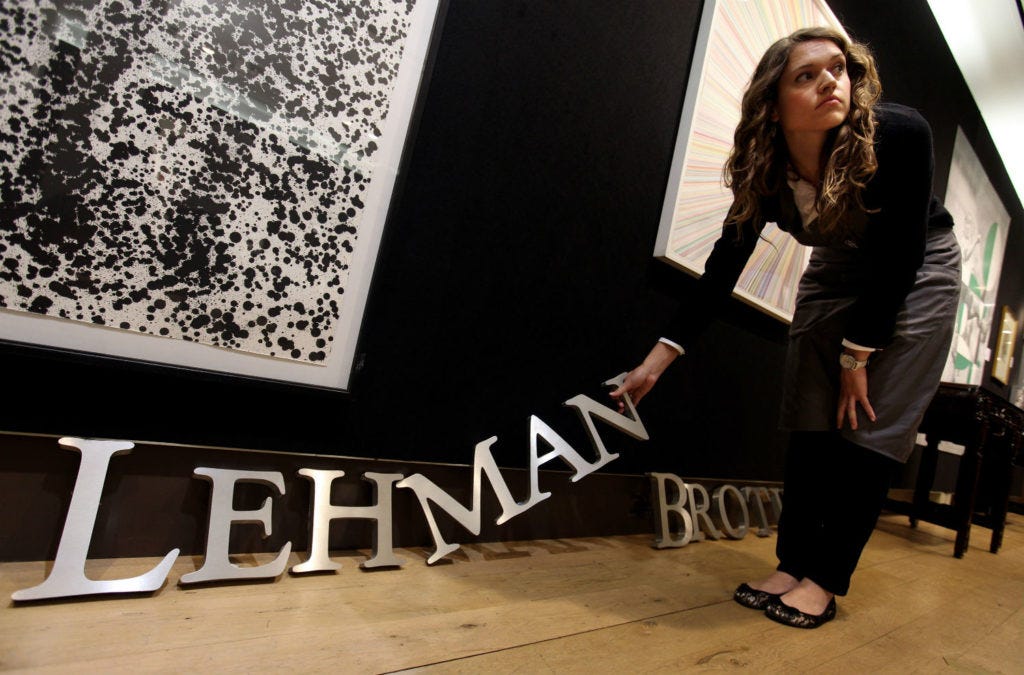

14 years ago, on September 15, 2008, 158-year-old U.S. investment bank Lehman Brothers filed for bankruptcy — the largest in U.S. history. On the same day, U.K. artist Damien Hirst's auction at Sotheby’s generated $201 million, exceeded expectations, set a world record, and occurred as global financial markets plunged.

This is a story of how art intersected with finance and became a safe haven when global financial markets plunged.

On a crisp November afternoon in 2008, a hedge fund manager was having wine with his wife at their oceanside home in Newport Beach, California, when a neighbor unexpectedly dropped by, looking visibly upset and exhausted by the ongoing liquidity crisis in New York.

Declining wine in favor of a deep shot of whiskey, the neighbor proceeded to tell the hedge fund manager that he failed to sell his chain of children’s clothing stores to a private investor. The investor, one of Europe's wealthiest businessmen, had, in the neighbor’s words, gone “totally mad.”

Knowing there were numerous deal opportunities available, the hedge fund manager was surprised and asked why the deal failed.

“I was surprised too,” the neighbor responded, helping himself to another shot of whiskey, “until I heard the reason.” He put his drink down and, eyes brimming with anger, looked at the hedge fund manager and said, “This guy has gone totally crazy about art and has spent over a hundred million dollars on some stupid sharks and bulls in London on the day Lehman Brothers collapsed.”

(158-year-old investment bank Lehman Brothers filed for bankruptcy on September 15, 2008 — the largest in U.S. history. Hundreds of business-suited employees — “masters of the universe” — left the bank’s offices one by one with boxes containing their personal belongings in their hands. It was a somber reminder that nothing lasts forever — even in the financial and investment world.)

(At the time of its collapse, Lehman was the fourth largest bank in the U.S. with 25,000 employees worldwide. It had $639 billion in assets and $613 billion in liabilities. The bank became the symbol of the excesses of the 2007 - 2008 financial crisis, engulfed by the subprime mortgage meltdown that swept through global financial markets, and cost an estimated $10 trillion in lost economic output.)

(Meanwhile, on the same day of Lehman’s collapse, U.K. artist Damien Hirst's auction of whole animals in formaldehyde, medicine cabinets, and spot and spin paintings at Sotheby’s London generated $201 million in sales. The auction exceeded expectations, set a record for a single-artist auction, and occurred as global financial markets plunged.)

The neighbor’s look begged a sympathetic response. The deal for his stores involved a mere $10 million. The liquidity crunch had forced him to either sell the firm or face bankruptcy under the pile of debt he had accumulated. He couldn’t understand how, given the current condition of the global economic meltdown, someone could withdraw his investment offer and focus on art.

“How can art sell for nine digits, and more than my company?” the neighbor asked.

“Why not?” the hedge fund manager’s wife replied. “It’s nice, and someone has the money.” The wife betrayed her belief that rules were meant to be broken and that everything was possible.

The neighbor refused to let it stop at that. “It generates no cash flow, has no liquidity, and there’s no one else on earth who would pay that kind of money again. This is crazy!”

The hedge fund manager’s wife smiled and said, “Well, you’re the ones in finance, not me. It’s not the first time it happened, and I don’t think it’ll be the last. So, who is crazy now?”

(In his 2009 book, A Colossal Failure of Common Sense: The Inside Story of the Collapse of Lehman Brothers, former Lehman vice president Lawrence MacDonald summarized that Lehman CEO Dick Fuld’s personal art collection was worth more than $200 million at the top of the market. The 31st floor at Lehman looked more like a Sotheby’s art collection center than the nerve center of what had become a $750 billion hedge fund.)

The insight

Investing in art isn't a new phenomenon — art has acted as a safe haven in times of crises since the middle ages.

Art in a portfolio has the ability to diversify and insulate against the economic volatility of politics, the stock market, bonds, real estate, and even gold. Studies have found that art outperforms traditional asset classes over the long term, outperforms during high inflation, has very low correlation with traditional asset classes, and low frequency of loss.

The late billionaire businessman and art collector J. Paul Getty (1892 – 1976), said it best:

“It remains an undeniable fact that fine art is a fine investment. The dollars-and-cents values of paintings, sculpture, tapestries, fine antique furniture, and virtually all forms of art have shown a marked tendency to rise — and even soar — over the years. Much of this, of course, is due to the increased — and still increasing awareness that art represents basic values that are not only lasting, but that become more valid as time goes on. Thus, there is competition to secure works of art — and thus their monetary value, the price people are willing to pay for them, rises.”

One of the best ways to protect ourselves from economic and geopolitical uncertainty is to invest in high quality art over the long term. Art provides the world with a sensory experience like no other. To own a piece of this world is a dream, to view it, a privilege, and to earn a rate of return on it, a bonus.

The International Investor provides profitable investment intelligence. We invest in the world’s highest quality businesses, with high and sustainable returns on capital, and in alternative assets like art, at attractive prices and margins of safety to what they're intrinsically worth.

The content is for informational purposes only and is neither an offer to buy or sell securities nor investment advice. Forward-looking statements may be uncertain and historical returns may not predict future performance. The International Investor is not a registered broker-dealer, investment adviser, or fiduciary.