The Southeast Asian businesses below are forecast to significantly grow their revenues, earnings, cash flows, earnings per share, and returns on equity by over 20% per year, respectively, over the next three years. Businesses with high and sustained growth rates that outperform their respective markets, industries, and inflation rates are attractive to investors. Their share prices are more than likely to appreciate over time.

🇲🇨 Indonesia

Map Aktif Adiperkasa

Operates as a sporting goods retailer in Indonesia.

Earnings and revenue are forecast to grow 23.0% and 21.0% per year, respectively, over the next three years.

Earnings per share is expected to grow 20.1% per year.

Return on equity is forecast to grow to 26.3% in three years.

Kencana Energi Lestari

Together with its subsidiaries, operates as a renewable energy company in Indonesia.

Earnings are forecast to grow 69.4% per year over the next three years.

Bank Jago

Provides various banking products and services for small and medium enterprises in Indonesia.

Earnings are forecast to grow 94.6% per year over the next three years.

🇨🇷 Thailand

Asia Aviation

Provides airline services in Thailand.

Earnings and revenue are forecast to grow 107.2% and 23.0% per year, respectively, over the next three years.

Return on equity is forecast to grow to 21.6% in three years.

Airports of Thailand

Engages in the airports business in Thailand.

Earnings are forecast to grow 48.4% per year over the next three years.

Royal Plus

Engages in the manufacture and distribution of beverages, fruit juices, fruit juices with basil seeds, fruit juices with chia seeds, coconut milk, and soy milk.

Earnings are forecast to grow 142.5% per year over the next three years.

🇸🇬 Singapore

LHN Logistics

An investment holding company that provides logistics management solutions in Singapore, Malaysia, Myanmar, and Thailand.

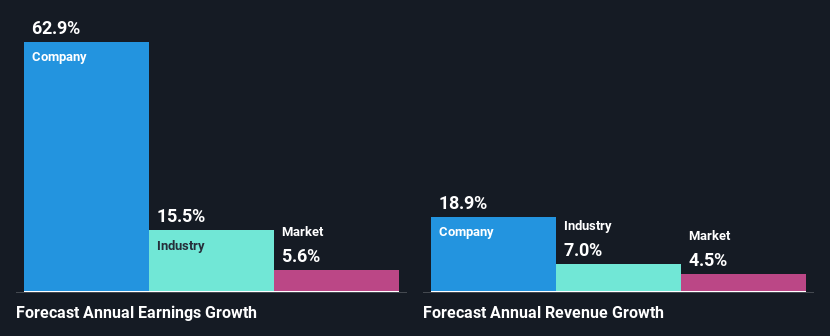

Earnings and revenue are forecast to grow 62.9% and 18.9% per year, respectively, over the next three years.

Earnings per share is expected to grow 63.2% per year.

Return on equity is forecast to grow to 23.7% in three years.

Jumbo Group

Operates and manages a network of restaurants in Singapore, the People’s Republic of China, and Taiwan.

Earnings are forecast to grow 48.0% per year over the next three years.

Seatrium

Provides offshore and marine engineering solutions.

Earnings are forecast to grow 53.9% per year over the next three years.

🇲🇾 Malaysia

Sunview Group Berhad

Engages in the engineering, procurement, construction, commissioning, and installation of solar photovoltaic (PV) facilities in Malaysia.

Earnings and revenue are forecast to grow 25.2% and 31.2% per year, respectively, over the next three years.

Earnings per share is expected to grow 44.2% per year.

Return on equity is forecast to grow to 21.3% in three years.

SFP Tech Holdings Berhad

Provides engineering supporting services in Malaysia and internationally.

Earnings are forecast to grow 28.7% per year over the next three years.

LGMS Berhad

Provides professional cyber security services in Malaysia and internationally.

Earnings are forecast to grow 42.9% per year over the next three years.

🇵🇭 Philippines

AyalaLand Logistics Holdings

Engages in the real estate business in the Philippines.

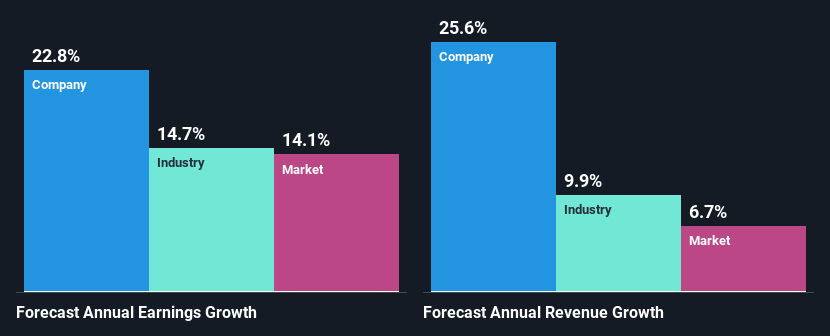

Earnings and revenue are forecast to grow 22.8% and 25.6% per year, respectively, over the next three years.

Earnings per share is expected to grow 22.4% per year.

Bloomberry Resorts

Develops, owns, and operates hotels, casinos, and integrated tourism resorts in the Philippines and Korea.

Earnings are forecast to grow 28.5% per year over the next three years.

RL Commercial REIT

A real estate company which invests in various real estate properties.

Earnings are forecast to grow 74.1% per year over the next three years.

🇻🇳 Vietnam

Ha Do Group

Engages in the real estate, energy development, construction, and trading and service businesses in Vietnam.

Earnings and revenue are forecast to grow 52.0% and 27.7% per year, respectively, over the next three years.

Return on equity is forecast to grow to 21.3% in three years.

Taseco Air Services

Operates in the airport commercial services field in Vietnam.

Earnings are forecast to grow 43.9% per year over the next three years.

VietJet Aviation

Provides passenger and cargo air transportation services, and airline-related support services.

Earnings are forecast to grow 87.1% per year over the next three years.

I will include your post in the stock picks section of my Monday links collection newsletter on https://emergingmarketskeptic.substack.com/ ....Check out some of my short tear sheets: https://emergingmarketskeptic.substack.com/s/emerging-market-stock-pick-tear-sheets