From Godzilla to Financial Godzilla: Japan's Economic Transformation

From Boom to Bust to Boom and Beyond

In 1989, Japan was at its economic peak. It was the world’s largest exporter of goods. The currency was strong. It owned over a third of America’s debt. The central bank’s interest rate was low, at 2.5%. Money growth was uncontrolled, and credit was easy. The country was swimming in money. Speculation abound. Real estate and stock prices were going through the roof. Western scholars, economists, and pundits predicted that Japan would overtake the US and become the world’s largest economy.

Japanese banks were the largest in the world.

Japanese real estate was worth four times more than US real estate. Tokyo’s Imperial Palace was worth more than California. Tokyo real estate was sold for as much as JP¥30 million (US$240,000) per square meter and was 350 times more valuable than an equivalent space in Manhattan.

An exclusive golf club membership costs as much as JP¥400 million (US$3.2 million). Memberships became tradeable assets worth US$200 billion.

Japanese companies went on trophy shopping sprees and bought top-of-the-line office towers in America’s major cities: New York’s Rockefeller Center and Exxon building, Los Angeles’ historic Biltmore Hotel and Arco Plaza, Northern California’s Pebble Beach, San Francisco’s Citicorp Center, Hollywood’s Columbia Pictures, Hawaiian resorts, and the world’s most expensive art.

The setting of the 1988 action film Die Hard, starring Bruce Willis and Alan Rickman, was changed from American-owned Klaxon Oil to Japanese-owned Nakatomi Plaza to fit the times.

A bar hostess-turned-restaurant owner became famous for using a ceramic money toad to accurately predict Japanese stock prices. Under the money toad’s watchful glare, high-powered bankers and the crème de la crème attended the Dark Lady of Osaka’s midnight seances and sought to divine where they should invest next. Banks lent her JP¥2.8 trillion (US$22.4 billion) backed by fake certificates of deposit. She became Japan’s wealthiest woman and the largest private investor. She bought up to JP¥120 billion (US$960 million) of stocks in a day and became the largest shareholder of Fuji Heavy Industries, Toshiba, and the Industrial Bank of Japan.

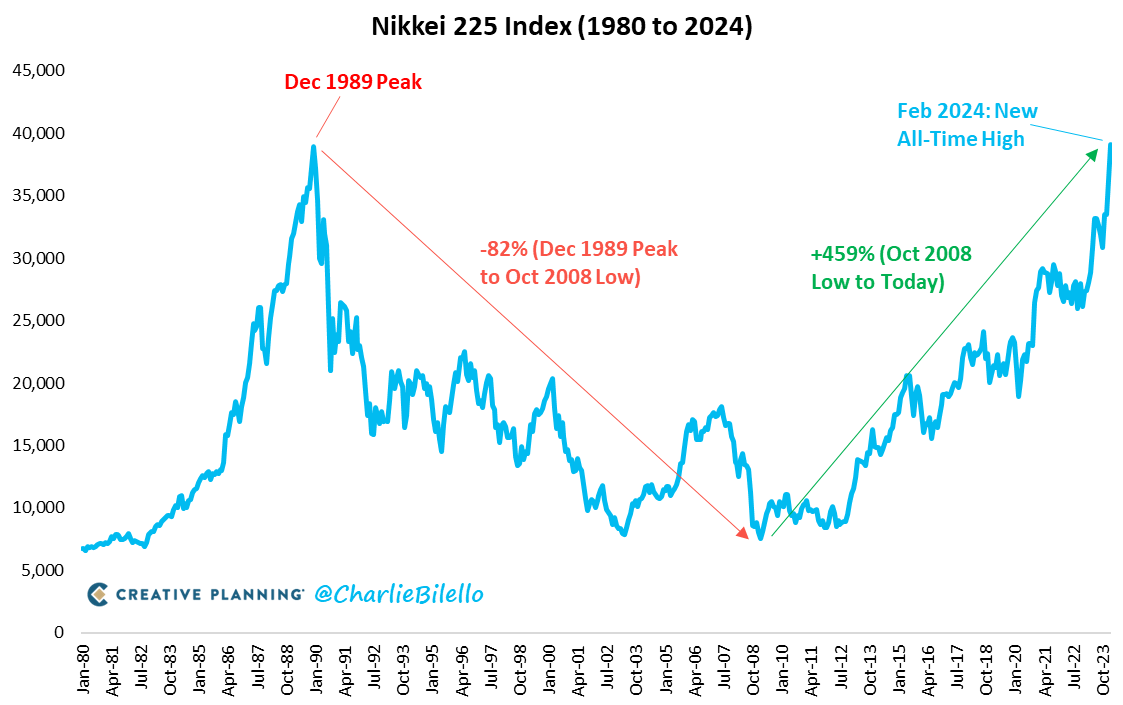

The party ended in 1990. The central bank hiked the interest rate to 4.25%, then to 6.0%. Japanese asset prices collapsed. Over the next 19 years, from their peak to 2008, stocks fell 82%, real estate fell 81%, and golf club membership prices fell 95%.

The Dark Lady of Osaka was arrested in 1991 and eventually thrown in jail. The ceramic money toad, however, managed to slip away, and its whereabouts remain a mystery to this day.

Fast forward to Thursday, February 22, 2024, after over 34 years of anticipation, trading floors across Tokyo erupted in cheers and applause as the market session drew to a close. The Nikkei 225, Japan’s primary stock index, soared to a new all-time high above 39,000, reminiscent of the record highs witnessed during the late-1980s asset bubble.

What’s fueling this remarkable surge? Several factors are at play, heralding what many perceive as a new era for the Japanese market. A weakening yen and diminishing prospects in China have enticed foreign investors, including prominent figures like super investor Warren Buffett, while simultaneously boosting the earnings of heavyweight exporters. Furthermore, corporate governance reforms have catalyzed a surge in stock buybacks, leading to a reduction in excessive cash balances and strategic cross-holdings between conglomerates. This resurgence occurs against a backdrop of growing optimism that Japan has finally broken free from the shackles of deflation, with major industries pouring investments into sectors ranging from semiconductors to artificial intelligence.

Another driving force behind this remarkable surge lies in the growth of total earnings among Japanese listed companies, which grew by an impressive 112% (7.8% per year) over the past decade. Moreover, the market’s total value has grown by an equally strong 126% (8.5% per year), aligning closely with the growth trajectory of earnings.

Interestingly, these record-breaking stock gains unfold against the backdrop of a Japanese economy grappling with recession. Just last week, Germany ousted Japan as the world’s third-largest economy by nominal GDP in dollar terms, attributed to a weakening yen and an aging population that poses challenges for replacement.

Nonetheless, it’s important to note that the stock market doesn’t perfectly mirror the economy, as it factors in elements such as monetary policy, stock ownership structures, earnings and cash flow growth, and forward-looking investor sentiment.

Has the ceramic money toad of the Dark Lady of Osaka returned?