India: A land of diversity and growth

India is a country with a rich culture, a thriving startup ecosystem, and a unique payment system. Its growth and potential as a world leader make it an interesting and exciting place to learn about.

Contributed by India analyst and investor Bhaumil Patel.

India is a country with a rich culture and history. With a population of 1.4 billion people, it is the world’s second-most populous nation. The country is divided into 28 states and eight Union territories, each with its unique language, culture, fashion, and cuisine. This diversity is what makes India unique and a melting pot of various cultures.

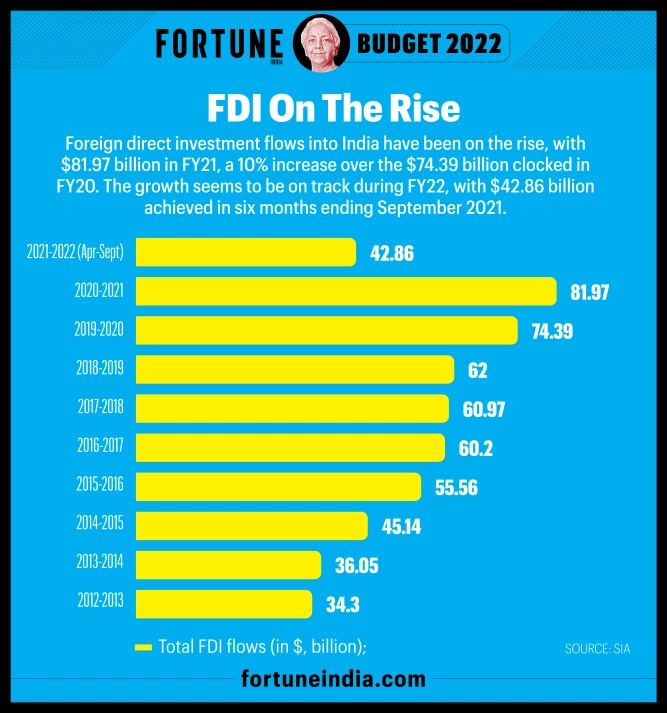

Investment in India is on the rise, with Foreign Direct Investment (FDI) increasing significantly in the past five years. In 2016, FDI was US$56 billion, and it reached US$82 billion in 2021. This increase in investment is a testament to India’s growth as a country and its potential as the world’s next growth engine.

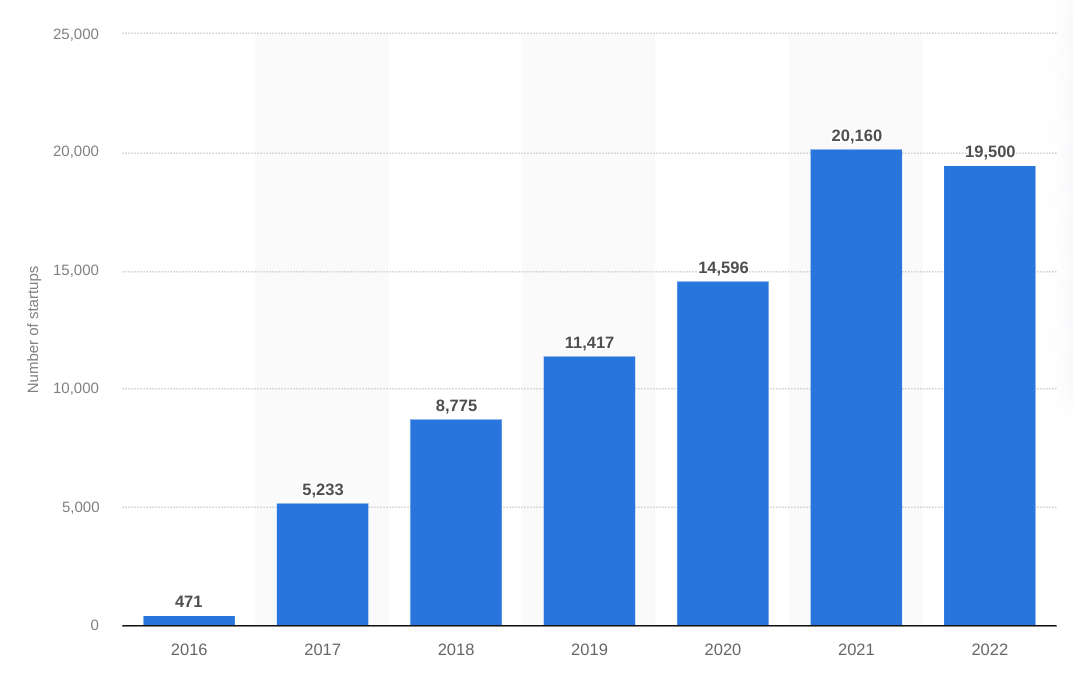

India is also home to a thriving startup ecosystem, with 80,000 new startups emerging in the last six years. The country has the second-highest number of startups in the world, and many are successful and innovative.

India also boasts a unique payment system called the Unified Payments Interface (UPI), which allows for real-time cash transfers between bank accounts using mobile phones. It allows you to access multiple bank accounts through a single mobile app of any participating bank. It merges multiple banking features such as fund routing and merchant payments into one unified platform.

According to Forbes, India’s digital payment transactions have surpassed those of the US, UK, and China combined. In 2020, India’s total digital payment transactions reached US$25 billion, which is 40% of all global payments in India.

The Indian rupee has the potential to become a world currency, with several countries in talks with India for adopting it as a mechanism for trade settlements. One of the first countries to accept the Indian rupee for trade settlement was Russia. India’s central bank, the Reserve Bank of India (RBI), must approve the arrangement before the trade settlement can start in Indian rupees.

For example, when an Indian buyer wants to buy something from Russia, they must first convert their rupee currency into US dollars to pay the seller. Both the buyer and seller will pay a fee for the currency conversion. However, they can avoid paying this fee by using a Vostro account.

A Vostro account is a way for the buyer and seller to receive and pay for the goods in Indian rupees, if the seller has a rupee Vostro account. The amount of the transaction will be credited to this account and when the seller needs to be paid, the amount will be deducted from this account and credited to the seller’s account.

For this to happen, a Russian bank may approach an approved bank in India to open a Special Rupee Vostro account. The bank will then get approval from the Reserve Bank of India, India’s central bank, before the account can become operational. Once approved, the two parties can start trading and settling in Indian rupees. The exchange rate between the two countries’ currencies may be determined by the market.

In conclusion, India is a country with a rich culture, a thriving startup ecosystem, and a unique payment system. Its growth and potential as a world leader make it an interesting and exciting place to learn about.