Indonesia's Sovereign Wealth Fund, INA, Secures Strategic Backing for Toll Road Platform from Global Powerhouses ADIA and APG

How has INA performed?

In a significant development for Indonesia’s sovereign wealth fund, the Indonesia Investment Authority (INA), the US$984 billion Abu Dhabi Investment Authority (ADIA) and Europe’s largest public pension fund, the Netherlands’ US$546 billion APG, have thrown their weight behind a transformative toll road platform, according to a report by global sovereign wealth fund data tracker Global SWF. This initiative, commencing with the Trans Java Toll Road mega-project, is set to receive a joint investment of US$2.75 billion, stemming from a Memorandum of Understanding (MoU) signed by APG and ADIA in May 2021. The agreement outlined their shared commitment to supporting road infrastructure in Southeast Asia’s most populous economy.

INA, positioning itself as a pivotal collaborator for foreign investors seeking exposure to Southeast Asia’s burgeoning economy, particularly as an alternative to China, recently concluded a US$1.36 billion investment in two sections of the Trans Sumatera toll road in partnership with state-owned construction firm PT Hutama Karya.

With an ambitious goal to grow its Assets under Management (AuM) to US$20 billion, INA is actively seeking third-party investors, both domestic and foreign, to drive this expansion. Marita Alisjahbana, the Chief Risk Officer of INA, emphasized the importance of optimal asset allocation and value creation. She stated, “Our ideal partner should bring not only capital but also expertise and technology that can support Indonesia’s sustainable development, with the goal of maximizing Foreign Direct Investment (FDI) into the country.”

Indonesia, like the Philippines and other emerging markets, established a strategic sovereign wealth fund to encourage co-investments, often with other sovereign wealth funds, in crucial sectors. INA represents a new wave of “catalytic funds,” designed to attract foreign capital into the country, focusing on road infrastructure, seaport facilities, and airports in collaboration with international partners.

Ridha Wirakusumah, CEO of INA, expressed the significance of welcoming APG and ADIA as shareholders, envisioning a strengthened capacity to support and advance strategic national development projects. The joint news release highlighted their commitment to fostering economic benefits and propelling Indonesia into a future of connectivity and prosperity.

Hans-Martin Aerts, Head of Infrastructure and Natural Resources at APG Asset Management Asia-Pacific, emphasized the foundational role of infrastructure in supporting economic growth and delivering stable, risk-adjusted returns. APG’s investment aims to unlock economic value by enhancing connectivity between developing rural and urban regions through quality infrastructure.

Khadem Alremeithi, Executive Director of Infrastructure at ADIA, acknowledged Indonesia as one of the world’s fastest-growing economies, undergoing infrastructure development to support increased industrialization and efficient supply chains. ADIA, along with INA and APG, remains committed to supporting the development of the Trans Java Toll Road and seeks additional opportunities to invest in Indonesia’s toll roads.

As INA aggressively markets itself since its inception in 2021, with an initial capital of US$1 billion, it has garnered substantial support and raised around US$26 billion in investments. The fund’s success is attributed to its focus on attracting foreign capital into the country, aligning with the broader shift towards inbound investments, and securing backing from influential entities such as DP World, Abu Dhabi Growth Fund, Silk Road Fund, US International Development Finance Corp., and Canadian pension fund CDPQ. INA’s diverse portfolio spans toll roads, telecommunication towers, healthcare, renewable energy, and technology.

How has INA performed?

In 2022, INA remained steadfast in its dedication to investing in strategic growth sectors, aiming to accumulate wealth for future generations and contribute to the sustainable economic development of Indonesia.

Established by the Government of the Republic of Indonesia in 2021 as the nation’s sovereign wealth fund, INA is committed to empowering key sectors of the Indonesian economy and fostering socio-economic progress for its people. With a staged capital injection of up to Rp75 trillion (US$4.8 billion) until the end of 2021, INA is positioned to fuel Indonesia’s long-term prosperity.

Excitingly, INA announces successful investment commitments exceeding Rp400 trillion (US$26 billion) from both domestic and foreign investors, demonstrating their commitment to creating lasting economic and social impact.

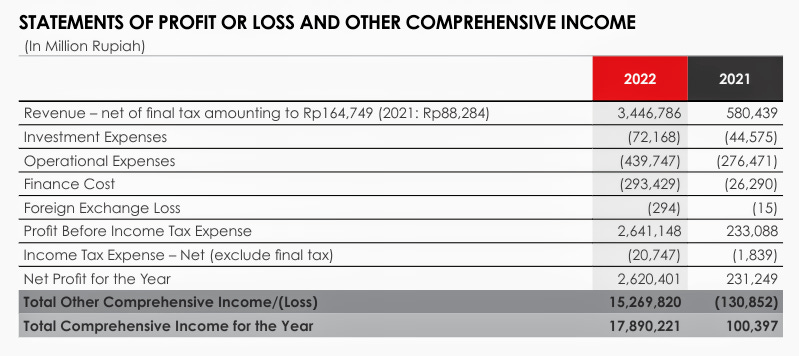

In 2022, INA achieved a remarkable net profit of Rp2.62 trillion (US$168 million), marking a substantial increase of over 10 times compared to 2021. This growth aligns with the expansion of total assets and equity to Rp99.8 trillion (US$6.4 billion) and Rp96.9 trillion (US$6.2 billion), respectively, emphasizing INA’s commitment to transparency and accountability through financial reporting adhering to International Financial Reporting Standards (IFRS).

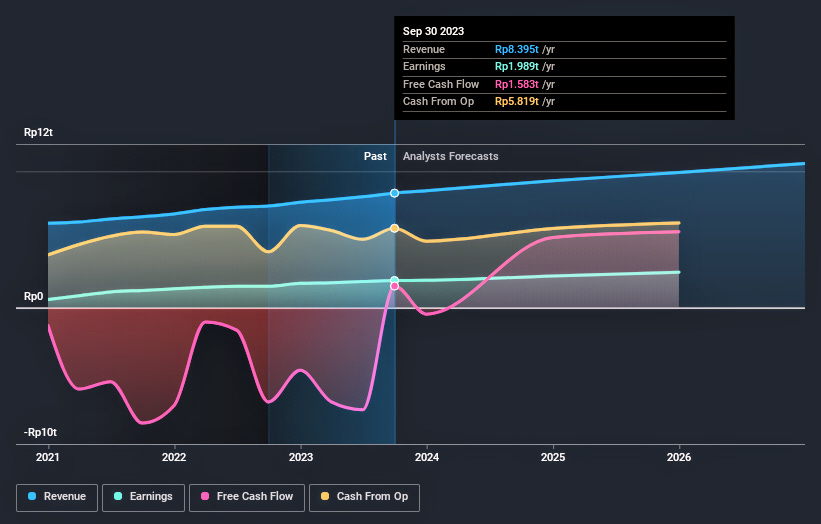

INA’s first investment in telecommunication tower company Mitratel in 2021 has proven to be a resounding success, showcasing impressive financial and operational outcomes. Mitratel’s robust financial performance is evident in its September 2023 (12 months) earnings of Rp1.99 trillion (US$127 million), marking a substantial 58% growth from September 2021.

Operationally, Mitratel expanded its portfolio by acquiring over 7,000 towers throughout 2022, surpassing a total of 35,000 towers by the end of December 2022. This solidifies Mitratel's position as the foremost telecommunication tower company in Indonesia.

Mitratel anticipates a robust trajectory of growth, with projections indicating a 12.7% annual increase in earnings and a 6.1% annual rise in revenue. Looking ahead, Mitratel aims for a promising Return on Equity (ROE) of 7.2% within the next three years. These forecasts underscore Mitratel’s strategic positioning and commitment to sustained financial strength and performance.

Strategically, INA made significant investments in key sectors, including signing its first deal in the Energy Transition Mechanism (ETM) and Electric Vehicle (EV) ecosystem during the B20 Presidency forum and entering the healthcare industry with its initial investment. Other notable achievements include signing an Investment Framework Agreement with China’s Silk Road Fund, focusing on digital and healthcare sectors, and collaborating with the Investment Fund for Developing Countries of the Kingdom of Denmark to advance green energy transition and inclusive social development.

Furthermore, INA entered agreements with global financial institutions, including BlackRock, Allianz Global Investors, Orion Capital Asia, to provide a financing facility to Traveloka, a trailblazer in digital transformation in the travel sector in Indonesia and Southeast Asia.

INA believes these 2022 investments will have enduring benefits on people’s lives. The healthcare industry investment aims to enhance access nationwide through optimized retail and healthcare delivery channels and digitalization. The ETM and EV deals align with Indonesia’s Net Zero Emission initiative, contributing to carbon emission reduction and environmental sustainability. Additionally, investments in infrastructure, such as toll roads and ports, play a crucial role in supporting economic development, growth, and facilitating trade.

As a responsible sovereign wealth fund, INA upholds a robust governance and risk management framework adhering to international standards. Joining the International Forum of Sovereign Wealth Funds (IFSWF) in September 2022 as a full member further solidifies INA’s commitment to the Generally Accepted Principles and Practices known as The Santiago Principles. INA’s membership in IFSWF provides access to best practices, networking opportunities, and enhances its reputation, reinforcing its dedication to responsible investment and good governance.