Phoenix Petroleum is looking for investors

Is Phoenix worth investing in? How much is it worth? Is it under or overvalued?

Phoenix Petroleum (PSE: PNX) of Philippine billionaire Dennis Uy reported on May 3, 2021 that its shareholders granted management the authority to negotiate with third parties on the possible sale of assets to raise funds and reduce debt.

In an earlier disclosure, the firm also stated that it is “open to consider any investor willing to invest and believes in the operations of the company and can further add value to its business activities.”

Reports and rumors have been circulating that supermarket billionaire Lucio Co, the Delgado Brothers Group, and unnamed foreign investors have expressed interest in buying a portion of Dennis Uy’s majority stake.

For investors outside of the Philippines and who don’t know, Phoenix engages in marketing and distribution of petroleum products to retail, commercial, and industrial customers under the Phoenix Fuels Life brand in the Philippines, Singapore, and Vietnam. The company operates through trading, depot and logistics services, and real estate segments. The company also engages in importing, manufacturing, marketing, and distribution of liquefied petroleum gas (LPG) and related products; and bitumen (asphalt) and bitumen-related products.

Phoenix also owns, operates, and franchises convenience stores under the Japanese FamilyMart brand; and Posible, a digital payments platform that offers various financial services and digital transactions, including payments and remittances.

Phoenix is a prominent player in the Philippine oil, gas, and consumable fuels industry. Its latest revenue for the 12 months ended December 2020 is ₱78.3 billion ($1.63 billion), and ranks third behind Petron’s revenue of ₱286 billion and Shell’s revenue of ₱157 billion.

As of December 2019, Phoenix operated 655 retail service stations; approximately 10,000 LPG and lubricant retail outlets; 11 terminal and depots; and 72 convenience stores.

Is Phoenix worth investing in? How has it performed in the past?

I will focus on two key fundamental metrics.

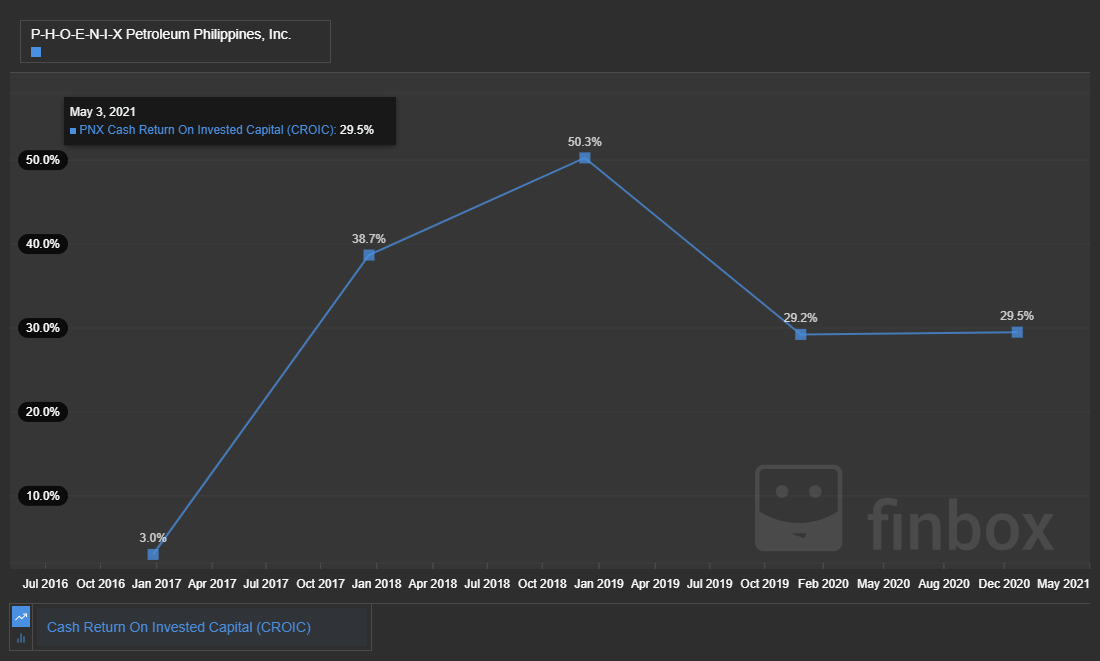

The first key metric is cash return on invested capital. It measures the amount of cash flow a business generates on each peso of capital invested and its ability to create value for all its stakeholders: customers, employees, government (via taxes paid), and suppliers of capital (debt and equity). It is a more accurate measure of performance and truer than accounting earnings.

While news reports fixated on Phoenix’s 20% drop in revenue and accounting net loss of -₱489 million in 2020 due to Covid-19 lockdowns, the company’s cash return on invested capital was a whopping 29.5% and averaged 30.1% since 2016! It significantly beat Shell’s cash return of 2.9% and others.

A big driver of Phoenix’s high cash flows and cash returns is its efficient inventory management. Its 42 days of inventory outstanding in 2020, which is how long it takes to convert inventory to cash, has been decreasing every year from 73 days in 2017, and is better than Shell’s 53 days.

The second key metric is economic profit. It measures a business’ ability to generate cash returns on invested capital, above its cost of capital. It is the primary test of shareholder value creation.

Broadly speaking, a business’ assets are financed by either debt or equity. The cost of capital is the average of these financing sources, each of which is weighted by its respective use.

The cost of capital can also be considered the weighted average rate of return a business theoretically pays to its debt and equity providers to compensate them for the risk they take by investing their capital.

Phoenix’s weighted average cost of capital is 10% and its cost of equity is 21%.

Since the cash return measures a business’s ability to create value for all its stakeholders, and the cost of capital measures the minimum return required by its capital providers (debt and equity), the difference between the cash return and the cost of capital is called economic profit.

Phoenix’s economic profit in 2020 is 19.5% (cash return of 29.5% less the cost of capital of 10%) and averaged 15.0% since 2017.

And this the best part: Phoenix’s average cash return of 30.1% also covered its cost of equity of 21%!

Clearly, Phoenix is worth investing in. Despite its accounting net loss in 2020, Phoenix generated high and sustained cash returns and economic profits, and has created value for all its stakeholders and shareholders since 2017.

How much is Phoenix worth? Is it under or overvalued compared to its fair value?

A business’ fair or intrinsic value is an estimate of how much cash it can generate in the future.

The International Investor buys a share when he believes the market underestimates the company’s future cash flows.

Using industry-standard valuation models of the biggest investment banks and money managers in the world, and based on future cash flow forecasts, Phoenix’s fair value per share estimate is ₱74.62.

The market is underestimating Phoenix’s future cash flows. Phoenix’s May 3, 2021 share price of ₱12.32 is trading 83.5% below its fair value estimate, and is, therefore, significantly undervalued.

The estimate is moderately certain due to the company’s 4% stock price volatility, which has been stable over the past year, predictable profit margins, and the number of valuation models used.

A prospective investor, whether he or she is buying part of Dennis Uy’s majority stake, or just a few shares, would be wise to invest. After all, a share is a piece of a business. Phoenix’s value appreciation beyond its fair risk-adjusted expected annualized return of 21% is highly likely over the long term. The market’s underestimated current price limits downside risk and maximizes upside potential.

The International Investor does not currently own shares of Phoenix Petroleum. This article is excerpted, edited, and sourced from the most recent company filings, company website, analysts’ reports, and S&P Global Market Intelligence. The content is for general informational and entertainment purposes only and should not be construed as financial advice.