SeA (Southeast Asia) Focus Portfolio

From its inception on December 16, 2023, to November 28, 2025, the portfolio delivered an annualized return of +50.5%, outperforming all Southeast Asian country index funds.

The International Investor manages the SeA (Southeast Asia) Focus Portfolio for a select group of investors and publishes its investment performance for the informational and educational benefit of investors and readers.

The portfolio invests in the highest-quality and fastest-growing businesses in Southeast Asia at attractive prices.

The portfolio is expected to generate superior returns over time with minimum business risk, regardless of the global market environment.

Earnings growth and returns on capital are the fundamental drivers of a business’s intrinsic, or true value. Businesses that focus on increasing their earnings and maintaining high returns on capital over the long term will ultimately reward investors with higher share prices.

The portfolio’s businesses are forecast to significantly grow their earnings and maintain their high returns on capital by at least 20% per year over the next three years, faster than their respective countries’ inflation rates, faster than their respective industries, and faster than their respective markets. As a result, their returns to investors, including dividends, are expected to be at least 20% per year as well.

Performance

From its inception on December 16, 2023, to November 28, 2025, the SeA Focus Portfolio delivered an annualized return (including unrealized, realized, dividend, and currency returns) of +50.5%.

The portfolio’s annualized return has outperformed the annualized returns of all Southeast Asian country index funds since inception on December 16, 2023:

SeA Focus Portfolio: +50.5%

iShares MSCI Singapore ETF: +25.6%

Global X MSCI Vietnam ETF: +23.2%

iShares MSCI Malaysia ETF: +11.6%

Global X FTSE Southeast Asia ETF (ASEAN’s Top 40): +11.1%

iShares MSCI Philippines ETF: -1.5%

iShares MSCI Thailand ETF: -2.9%

iShares MSCI Indonesia ETF: -7.7%

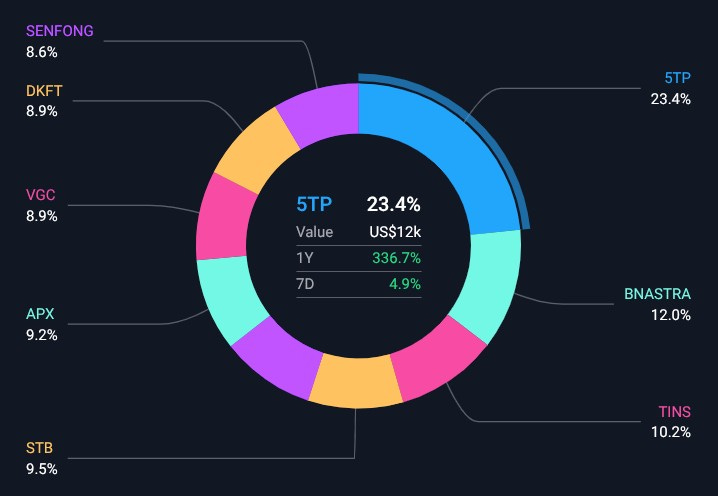

Current Holdings

As of November 28, 2025, the portfolio’s current holdings and their total returns (including unrealized, dividend, and currency returns) are:

CNMC Goldmine Holdings (5TP | Singapore): +224.7%

Saigon Thuong Tin Commercial Joint Stock Bank (STB | Vietnam): +33.0%

Binastra Corporation Berhad (BNASTRA | Malaysia): +29.1%

PT TIMAH Tbk (TINS | Indonesia): +7.6%

PT Ancara Logistics Indonesia Tbk (ALII | Indonesia): -0.6%

Central Omega Resources (DKFT | Indonesia): -2.5%

Apex Mining (APX | Philippines): -2.5%

Viglacera (VGC | Vietnam): -5.4%

Seng Fong Holdings Berhad (SENFONG | Malaysia): -7.5%

Future Growth of Intrinsic Value

The portfolio’s businesses are forecast to grow their earnings by +37.4% per year over the next three years and maintain their high returns on capital by at least 20% per year, faster than their respective countries’ inflation rates, faster than their respective industries, and faster than their respective markets. As a result, the portfolio’s real return to investors, including a dividend yield-on-cost of +2.7%, is expected to be at least +40.1% per year as well.