Sovereign Investors Navigate Challenges and Embrace Opportunities: Insights from the 2024 Global SWF Annual Report

I am delighted to share the key insights derived from the 2024 Global SWF Annual Report on sovereign investors (sovereign wealth funds, public pension funds, and central banks), released on January 1, 2024. These insights provide a comprehensive overview of the challenges, trends, and performance in the sovereign investment landscape.

Key Insights

1. Challenging Macro Scenario: Sovereign investors faced difficulties in thriving in 2023 due to geopolitical uncertainties and concerns about a potential economic crisis. Inflation is under control, and interest rates are expected to drop, but the financial markets reflect the broader challenges.

2. Global Economic Outlook: The World Bank estimates a poor global GDP growth of +2.1% in 2023, with a modest recovery to +2.4% in 2024. Climate change remains a significant concern, and artificial intelligence (AI) is anticipated to be a global disruptor.

3. Asset Under Management (AuM) Growth: The recovery of financial markets and sustained high oil prices led to a notable increase in sovereign investors’ AuM. Sovereign wealth funds (SWFs) reached US$11.2 trillion, public pension funds (PPFs) increased to US$23.1 trillion, and central banks (CBs) remained almost flat at US$15.4 trillion. The combined assets of these groups are expected to reach US$50 trillion in 2024, surpassing the 2021 peak.

4. Financial Market Performance: Despite geopolitical uncertainties, financial markets performed strongly in 2023. Global bonds (fixed income) and stocks (public equities) were up +8.4% and +20.7%, respectively. Private markets, including private equity and infrastructure, also showed positive growth.

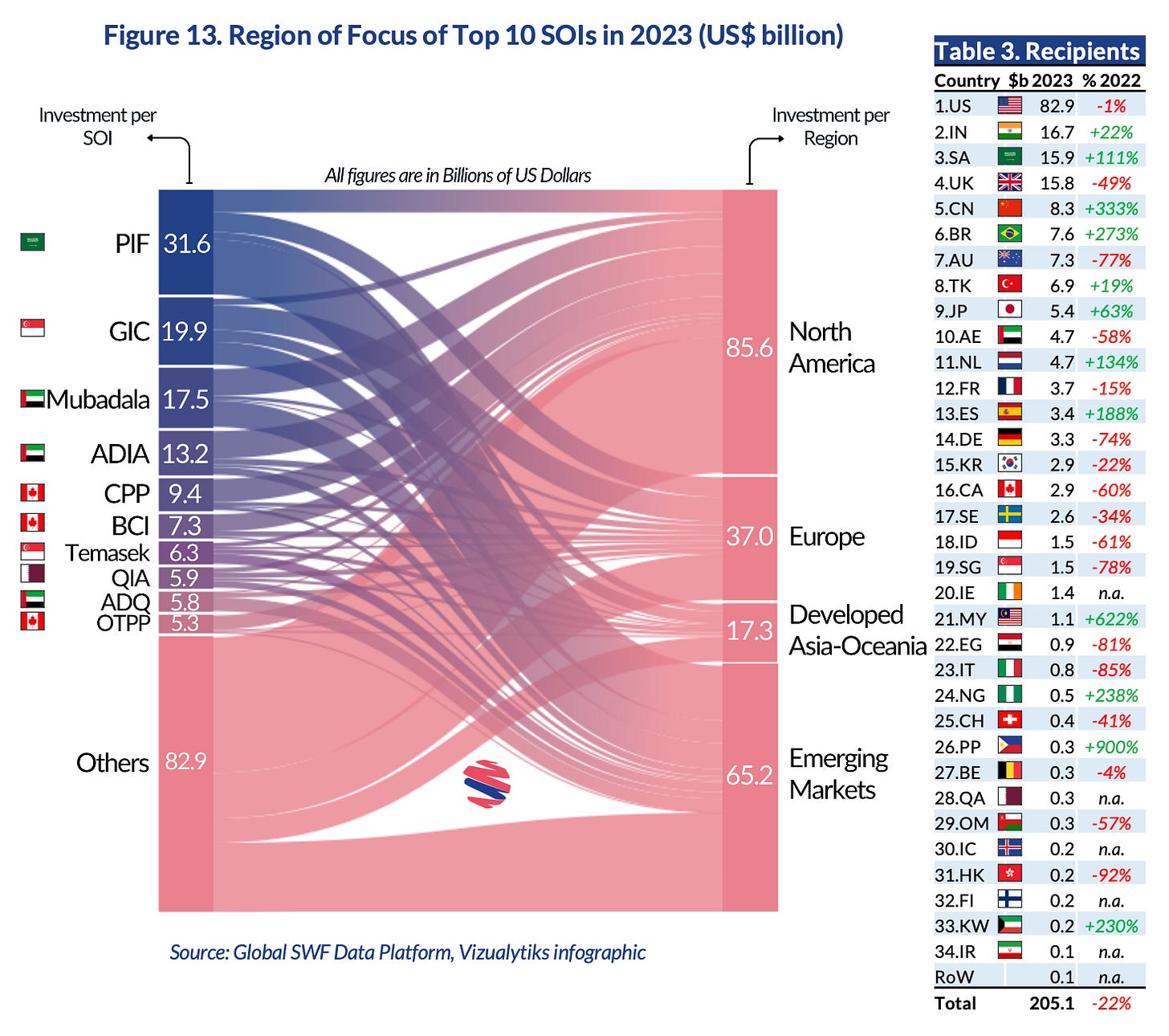

5. Investment Trends: Sovereign investors adopted an overly cautious approach in 2023, with investments falling in both value and frequency compared to 2022. The average deal size remained constant at US$350 million. Saudi Arabia’s Public Investment Fund (PIF) emerged as a lead investor, deploying US$31.6 billion in 49 deals.

6. Regional Investment Preferences: There is a shift in regional preferences, with a renewed interest in emerging markets. Half of the top sovereign investors (SOIs) invested more in emerging markets, particularly in China, Indonesia, Brazil, and India.

7. Industry Focus: Over 25% of investments were in real estate, marking a relative increase not seen since 2014. Financials and infrastructure remained popular, while industrial conglomerates saw increased investments due to Gulf investors. Technology integration with other industries was also noted.

8. Co-Investments: Co-investments grew over US$30 billion, with Gulf and Canadian funds leading in this trend. The Government of Singapore Investment Corporation (GIC) was highlighted as a prominent co-investor. Sovereign investors engaged in significant divestment activities, including initial public offerings (IPOs).

9. Equity Portfolio Growth: Most sovereign investors (SOIs) saw growth in their US equity portfolios due to the recovery in share values. Interest in Indian stocks remained high, while waning interest was observed in European and Chinese equities.

10. New Funds and Initiatives: Five new funds were launched, with the Philippines introducing the Maharlika Investment Fund, strategically capitalized at US$2.3 billion by state-owned banks and the national government. Following the successful models of India’s National Investment and Infrastructure Fund (NIIF) and Indonesia’s Nusantara Investment Authority (INA), Maharlika aims to draw co-investors for its infrastructure requirements. These strategic funds, embodying a trend observed over the past decade, blend financial objectives with economic missions, actively contributing to domestic development. Notably, some of these funds are initiated without substantial initial wealth, focusing on attracting foreign capital and fundraising from other sovereign investors.

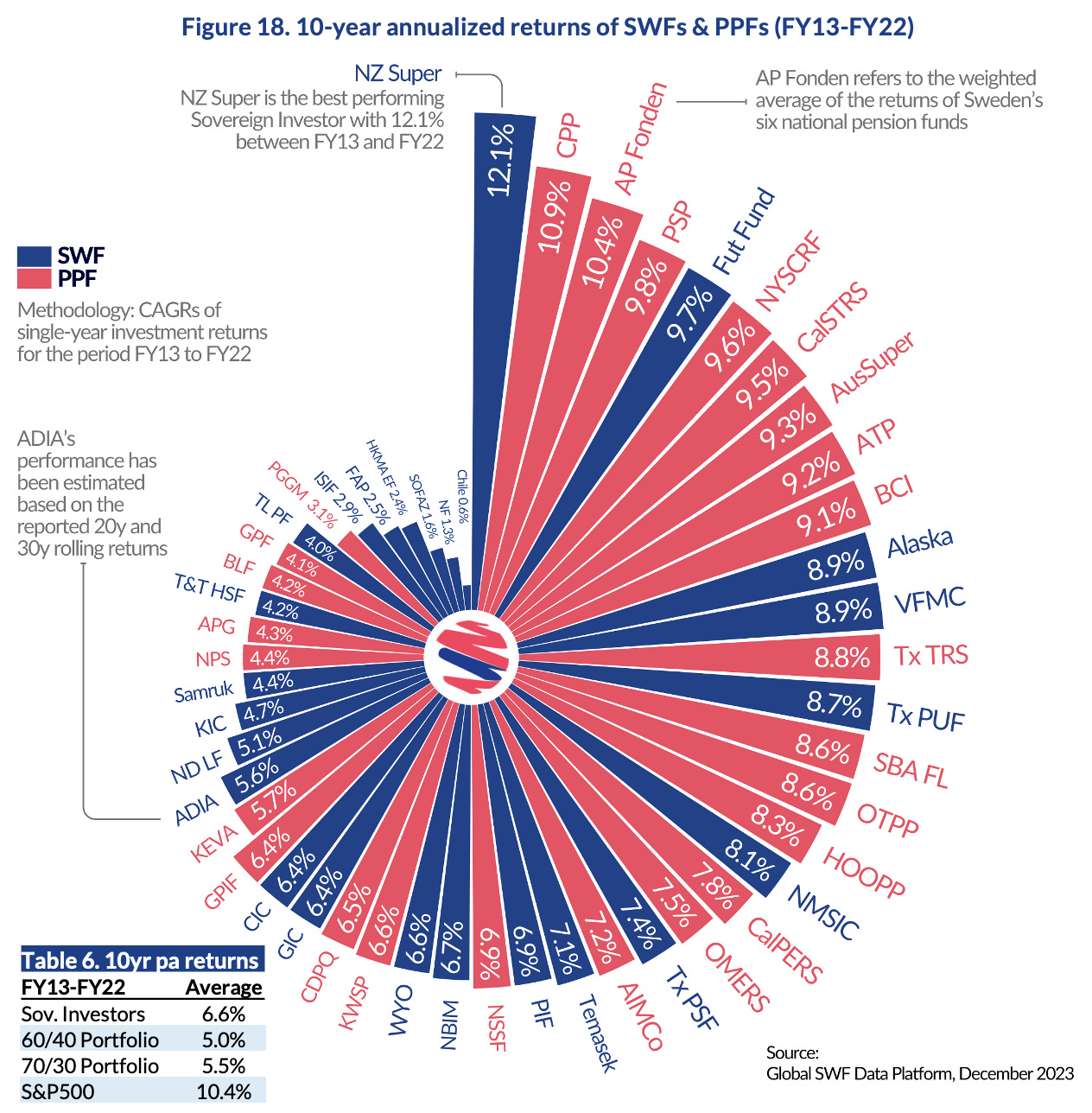

11. Best Performing Funds and Returns: When looking at annualized returns from 2013 to 2022, the New Zealand Superannuation Fund (NZ Super), Canada Pension Plan (CPP), and Sweden’s AP Fonden were identified as the best-performing funds, with returns exceeding 10% per year. The average return of all funds was 6.6% per year, exceeding the global 60% stock-40% bond portfolio return benchmark of 5% per year and the 70% stock-30% bond portfolio return benchmark of 5.5% per year.

The consistent and outstanding success of these best-performing funds over the 10-year period, including those exceeding the benchmark portfolios, underscores their prowess in navigating complex financial landscapes and solidifies their status as leaders in the realm of sovereign investment.