Sri Lanka and the Philippines are the top Asian Cub market gainers over the past week

Analysts are most optimistic about Sri Lanka and the Philippines' future earnings growth; Indonesia's market is the cheapest; and LS 2 Holdings is up 142%.

Asian Cubs

The Asian Cubs are 10 fast growing markets with a combined 846 million population of mostly young (under 30 years of age), educated, urbanized, and gentrified people (third highest in the world); digitized with 1.1 billion mobile phones (third most in the world); and, US$3.8 trillion of GDP (seventh wealthiest in the world).

McKinsey & Company calls these markets “the biggest growth opportunity in the history of capitalism.”

Key takeaways:

August 6 to 12, 2022

The Sri Lankan and the Philippine stock markets are up 8.4% and 3.9%, respectively, over the past week, and are the top Asian Cub market gainers.

Investors are most pessimistic about Indonesia’s future earnings growth rate, and neutral about Thailand, Vietnam, and Bangladesh.

Analysts are most optimistic about Sri Lanka and the Philippines’ future earnings growth rates, and least optimistic about Indonesia.

The Indonesian market is the most undervalued (cheapest); Malaysia is the least undervalued; and, Thailand, Vietnam, and Bangladesh are fairly valued.

LS 2 Holdings is up 142% over the past week and is the top Asian Cub business gainer.

Read more below.

Asian Cubs performance and valuation

👉 In the short term, investor sentiment and emotions drive shareholder returns. Over the long term, revenue, earnings, and free cash flow growth drive shareholder returns.

Ranked from highest total market value.

1. 🇲🇨 Indonesian market: +0.3%

Over the past 7 days, the market has remained flat, with no particular sector making any big moves during the week. More promisingly, the market is up 13% over the past year. As for the next few years, earnings are expected to grow by 10% per year.

Companies: 723

Total market value: Rp9,183.5 trillion (US$626 billion)

1-year growth: +26%

3-year growth: -84%

Total revenue: Rp4,192.0 trillion (US$290 billion)

1-year growth: +27%

3-year gowth: +18%

Total earnings: Rp538.6 trillion (US$37 billion)

1-year growth: +86%

3-year growth: +58%

Market valuation (PE*): 17.1x

Trading below the 3-year average PE* of 70.2x.

Investors and analysts are pessimistic, indicating they expect that earnings will not grow as fast as they have historically.

The market is undervalued (inexpensive).

2. 🇨🇷 Thai market: +1.3%

The market has climbed 1.3% over the past 7 days, led by the Energy sector with a gain of 4.1%. Over the past 12 months, the market is up 8.0%. Over the next few years, earnings are expected to grow by 19% per year.

Companies: 822

Total market value: ฿19.7 trillion (US$558 billion)

1-year growth: +13%

3-year growth: +20%

Total revenue: ฿14.8 trillion (US$419 billion)

1-year growth: +29%

3-year growth: +22%

Total earnings: ฿1.0 trillion (US$28 billion)

1-year growth: +15%

3-year growth: +17%

Market valuation (PE*): 19.5x

Trading close to the 3-year average PE* of 21.1x.

Investor sentiment is neutral, indicating they expect that earnings will grow in line with historical growth rates.

Analysts, however, are optimistic that earnings will grow faster than historical growth rates.

The market is fairly valued.

3. 🇸🇬 Singaporean market: -0.4%

The market has stayed flat over the past 7 days. In line with that, the market has also been flat over the past year. Over the next few years, earnings are expected to grow by 13% per year.

Companies: 558

Total market value: S$718.9 billion (US$524 billion)

1-year growth: -5%

3-year growth: +10%

Total revenue: S$543.9 billion (US$397 billion)

1-year growth: +13%

3-year growth: +12%

Total earnings: S$51.2 billion (US$37.3 billion)

1-year growth: +114%

3-year growth: +12%

Market valuation (PE*): 14x

Trading below the 3-year average PE* of 26.3x.

Investors are pessimistic, indicating they expect that earnings will not grow as fast as they have historically.

Analysts, however, are optimistic that earnings will grow faster than historical growth rates.

The market is undervalued (inexpensive).

4. 🇲🇾 Malaysian market: +0.2%

The market has been flat over the past week, however the Healthcare sector is down 4.7%. Unfortunately though, the market is down 3.5% over the past year. Over the next few years, earnings are expected to grow by 11% per year.

Companies: 939

Total market value: RM1.7 trillion (US$382 billion)

1-year growth: -3%

3-year growth: +1%

Total revenue: RM1.1 trillion (US$247 billion)

1-year growth: +10%

3-year growth: +9%

Total earnings: RM97.5 billion (US$21.9 billion)

1-year growth: +2%

3-year growth: +37%

Market valuation (PE*): 17.1x

Trading below the 3-year average PE* of 22.7x.

Investors are pessimistic, indicating they anticipate that earnings will not grow as fast as they have historically.

Investors are neutral, indicating they expect that earnings will grow in line with historical growth rates.

The market is undervalued (inexpensive).

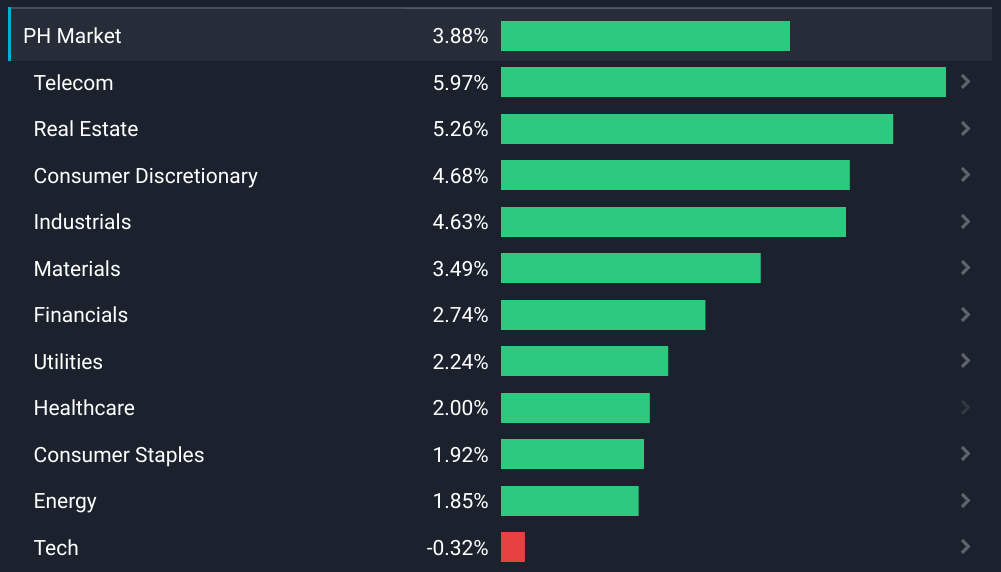

5. 🇵🇭 Philippine market: +3.9%

The market is up 3.9% over the past week, with the Industrials sector leading the way, up 4.6%. Over the past 12 months, the market is up 5.0%. Earnings are forecast to grow by 20% annually.

Companies: 253

Total market value: ₱13.2 trillion (US$237 billion)

1-year growth: +8%

3-year growth: -6%

Total revenue: ₱9.8 trillion (US$176 billion)

1-year growth: +22%

3-year growth: +6%

Total earnings: ₱878.6 billion (US$15.8 billion)

1-year growth: +43%

3-year Growth: +10%

Market valuation (PE*): 15x

Trading below the 3-year average PE* of 20.4x.

Investors are pessimistic, indicating they expect that earnings will not grow as fast as they have historically.

Analysts, however, are optimistic that earnings will grow faster than historical growth rates.

The market is undervalued (inexpensive).

6. 🇻🇳 Vietnamese market: +0.9%

Over the past week, the market has stayed flat, however the Healthcare sector stood out, gaining 8.7%. Over the past year, the market is down 8.0%. Looking forward, earnings are forecast to grow by 19% annually.

Companies: 752

Total market value: ₫5,290.2 trillion (US$226 billion)

1-year growth: -4%

3-year growth: +53%

Total revenue: ₫2,537.6 trillion (US$108 billion)

1-year growth: +5%

3-year growth: +17%

Total earnings: ₫348.9 trillion (US$15 billion)

1-year growth: +11%

3-year growth: +70%

Market valuation (PE*): 15.2x

Trading close to the 3-year average PE* of 16.5x.

Investor sentiment and analysts are neutral, indicating they expect that earnings will grow in line with historical growth rates.

The market is fairly valued.

7. 🇧🇩 Bangladeshi market: -2.3%

Over the past 7 days, the market has dropped 2.3%, driven by a pullback of 2.3% in the Financials sector. Over the past 12 months, the market is down 11%. Looking forward, earnings are forecast to grow by 11% annually.

Companies: 336

Total market value: ৳4.3 trillion (US$45 billion)

1-year growth: -11%

3-year growth: +36%

Total revenue: ৳2.4 trillion (US$25 billion)

1-year growth: +19%

3-year growth: +33%

Total earnings: ৳271.2 billion (US$2.85 billion)

1-year growth: +21%

3-year growth: +22%

Market valuation (PE*): 16x

Trading close to the 3-year average PE* of 17.7x.

Investor sentiment is neutral, indicating they expect that earnings will grow in line with historical growth rates.

Analysts, however, are optimistic that earnings will grow faster than historical growth rates.

The market is fairly valued.

8. 🇱🇰 Sri Lankan market: +8.4%

The market has climbed 8.4% over the past 7 days, led by the Industrials sector with a gain of 14%. In contrast, the Healthcare sector is lagging, dropping 4.8%. The market is up 5.8% over the past 12 months. Looking forward, earnings are forecast to grow by 26% annually.

Companies: 268

Total market value: LKRs3.9 trillion (US$11 billion)

1-year growth: +12%

3-year growth: +57%

Total revenue: LKRs5.6 trillion (US$16 billion)

1-year growth: +45%

3-year growth: +68%

Total earnings: LKRs651.6 billion (US$1.81 billion)

1-year growth: +85%

3-year growth: +160%

Market valuation (PE*): 6x

Trading below the 3-year average PE* of 11.1x.

Investors and analysts are pessimistic, indicating they expect that earnings will not grow as fast as they have historically.

The market is undervalued (inexpensive).

Asian Frontier Cubs

9. 🇰🇭 Cambodian market: +0.6%

Companies: 9

Total market value: KHR7,170.9 billion (US$1.75 billion)

1-year growth: -11%

3-year growth: +201%

10. 🇲🇲 Myanmar market: -1.3%

Companies: 7

Total market value: MMK574.0 billion (US$273 million)

1-year growth: -19%

3-year growth: -10%

* The PE, or Price to Earnings ratio, determines investor sentiment and perceived value for a market. It measures and compares values among mature and profitable companies, across markets, and across time. A higher than average PE indicates increased investor optimism, resulting in an overvalued (expensive) market. A lower than average PE indicates increased investor pessimism, resulting in an undervalued (inexpensive) market.

👉 Long term investors who focus on value investing (buying high quality businesses at below average prices) will find more opportunities in undervalued (inexpensive) markets.

Top Asian Cub business gainers over the past week

Ranked from the top business gainer in each Asian Cub market.

1. LS 2 Holdings: +142.4%

LS 2 Holdings Limited operates as an integrated environmental services provider in Singapore.

2. Lanka IOC: +52.7%

Lanka IOC PLC imports, sells, and distributes petroleum products in Sri Lanka.

3. Habco Trans Maritima: +32.7%

PT Habco Trans Maritima Tbk owns and operates bulk carriers in Indonesia.

4. LBC Express Holdings: +30.9%

LBC Express Holdings, Inc. provides logistics and money transfer services in the Philippines, the US, Canada, the Asia Pacific region, Europe, and the Middle East.

5. Sapura Energy Berhad: +22.2%

Sapura Energy Berhad, an investment holding company, offers integrated energy services and solutions in Malaysia, Australia, Africa, Turkey, the Americas, the Middle East, the rest of Asia, and internationally.

6. Licogi 14: +17.7%

Licogi 14 Joint Stock Company develops and constructs infrastructure projects in Vietnam.

7. Srithai Superware: +17.1%

Srithai Superware Public Company Limited, together with its subsidiaries, manufactures and distributes household plasticware and industrial products in Thailand, Vietnam, and internationally.

8. Sonali Paper & Board Mills: +6.9%

Sonali Paper & Board Mills Limited engages in the manufacturing and sale of various grades of paper in Bangladesh.

The best way to protect ourselves from economic and geopolitical uncertainty is to invest in high quality, cash generating businesses over the long term, that deliver real value to the economies they serve.

The International Investor provides profitable investment intelligence. I search the world for high quality businesses, with high and sustainable returns on capital, and attractive prices and margins of safety to what they're intrinsically worth.

This post is excerpted, edited, and sourced from analyst notes and S&P Global Market Intelligence. The content is for general informational and entertainment purposes only and should not be construed as investment advice.