The International Investor believes that a company’s intrinsic value results from the future cash flows it can generate. This report will analyze and determine if Jollibee, the McDonald’s of Asia, is an outstanding business and is trading at a discount or premium to their intrinsic worth or fair value estimate.

On March 16, 2021, Jollibee announced it is looking toward foreign expansion and “opportunities” created by COVID-19 as it rebounds from historic losses caused by the pandemic. Jollibee plans to open 450 restaurants around the world in 2021 while looking for acquisitions that could be funded with the company’s ₱57.1 billion ($1.2 billion) in cash and short term investments.

Business profile

Founded in 1975, Philippine-based Jollibee Food Corporation (PSE:JFC) develops, operates, and franchises quick service restaurants under the Jollibee, Chowking, Greenwich, Red Ribbon, Yong He King, Hong Zhuang Yuan, Mang Inasal, Burger King, Highlands Coffee, PHO24, Hard Rock Cafe, Dunkin’ Donuts, Smashburger, Tim Ho Wan, Tortas Frontera, The Coffee Bean & Tea Leaf, and Panda Express names. As of June 18, 2020, it operated approximately 5,800 stores in the Philippines, the US, Canada, China, Hong Kong, Macau, the UK, Italy, Vietnam, Brunei, Singapore, Saudi Arabia, the UAE, Qatar, Oman, Kuwait, Bahrain, Indonesia, Costa Rica, Egypt, El Salvador, Panama, Scotland, Malaysia, and internationally. Jollibee also offers property leasing, manufacturing, digital printing, advertising, financial accounting, human resources and logistics, business management, and other services.

Share price and news

How has Jollibee' share price performed over time and what recent events caused price changes?

Latest share price and events

Jollibee’s share price has been stable over the past three months. It is less volatile than 75% of Philippine stocks, typically moving +/- 4% a week. Its weekly volatility (4%) has been stable over the past year.

On March 23, 2021, Jollibee announced it is vaccinating all of its employees and their families in the Philippines, following a similar announcement from other firms. Beyond this and the recent expansion announcement, there were no recent or concerning events that caused significant price changes.

Market performance

As of March 23, 2021, Jollibee exceeded the Philippine hospitality industry, which returned 56% over the past year, and exceeded the Philippine market, which returned 32% over the past year.

Future growth

How is Jollibee forecast to perform in the next one to three years based on analysts’ estimates?

Earnings and revenue growth forecasts

Jollibee is forecast to become profitable in 2021 (₱4.2 billion or $86.5 million) and grow earnings over the next three years, from a pandemic induced loss of ₱-12.9 billion ($-265 million) in 2020, to ₱7.5 billion ($154 million) in 2023.

Analysts’ future growth forecasts

Jollibee is forecast to have an average annual earnings growth of 91% per year for the next three years, which is faster than the Philippine market (31.6% per year) and higher than the five-year average yield you would receive on a low risk Philippine long term government bond (4.9%).

While Jollibee’s revenue (14.3% per year) is forecast to grow slower than the industry (20.2% per year), its revenue (14.3% per year) is forecast to grow faster than the Philippine market (13.7% per year).

Future return on equity

Return on equity (ROE) is a profitability measure, which shows how efficiently a company’s management team has used its shareholders’ money to generate profits. An ROE of 20% or greater is considered to be indicative of a company that is highly profitable and efficient.

While higher than the industry, Jollibee's future return on equity is forecast to be low in three years time (13%).

Financial health

How is Jollibee’s financial position?

Financial position analysis

Jollibee’s short term assets (₱78.3 billion or $1.6 billion), which can be sold, converted to cash, or liquidated within one year, exceed its short term liabilities (₱56.6 billion or $1.2 billion), which are commitments that are due within one year. However, Jollibee’s short term assets do not cover its long term liabilities (₱89.8 billion or $1.8 billion), which are commitments that are due in more than one year.

Debt to equity history and analysis

Jollibee’s debt to equity ratio (97.1%), which measures how much it is financing its operations through debt versus wholly-owned funds, is considered high. A ratio of 40% or less is considered acceptable. The higher the ratio, the more debt it uses to fund its operations. Jollibee’s debt to equity ratio has increased from 18.5% to 97.1% over the past five years.

Jollibee’s debt is not well covered by operating cash flow (0.6%), which is how much cash it generates from its core business activities in a given period. Operating cash flow of at least 20% of debt is considered acceptable. Inadequate debt coverage indicates the company may continue to require external financing.

On the other hand, the company’s huge pile of cash and equivalents (₱57.1 billion or $1.2 billion) is high enough to cover its negative to low operating and free cash flows over the next year, should the level remain stable.

Management

How experienced are the management team and are they aligned to shareholders’ interests?

Jollibee's management team is seasoned and experienced. The average tenure is 6.4 years and the average age is 53.

Ernesto Tanmantiong (7.17 years tenure) has been the Chief Executive Officer and President of Jollibee since July 1, 2014. He served as Chief Operating Officer from January 2012 to July 1, 2014, Executive Vice President from November 2006 to July 1, 2014, and Treasurer from June 27, 2008 to July 1, 2014.

Jollibee's board of directors is seasoned and experienced. The average tenure is 18 years and the average age is 67.

Tony Tan Caktiong is the Founder of Jollibee and has been its Chairman of the Board since 2014, served as Chief Executive Officer and President until July 1, 2014, and has been an Executive Director since 1978.

Ownership

Who are the major shareholders and have insiders been buying or selling?

Ownership breakdown

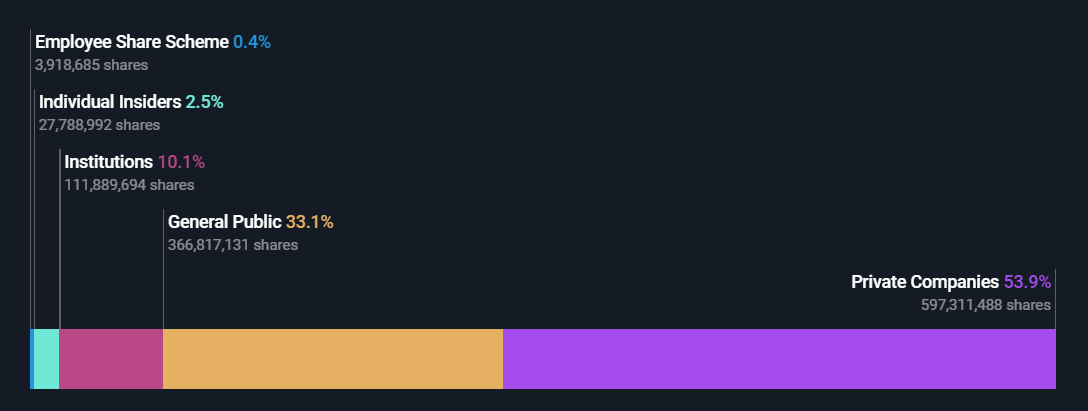

Insider-owned private companies, including those owned by the founders and their families, own 53.9% of Jollibee.

Insider trading volume

On March 3, 2021, Jollibee announced that its founders would consolidate ownership of a substantial portion of their shares into their private firm Hyper Dynamic Corp.

206.2 million shares were bought by Hyper Dynamic and another insider-owned private company, valued at approximately ₱37.4 billion ($768 million), while 192.7 million shares were sold by seven private companies, valued at approximately ₱23.1 billion ($475 million).

Overall, the private companies, which are owned by the founders and insiders, have bought more shares than they have sold in the past three months. This indicates that the founders and insiders are confident in the company’s future prospects.

Valuation

Is Jollibee undervalued compared to its estimated fair value and its price relative to the market?

Share price vs. estimated fair value

The International Investor uses a discounted cash flow valuation model to estimate a company’s fair value. It’s an estimate of what the stock price is worth today, based on the cash flows the company is expected to generate in the future. This is industry-standard and used by analysts from the most reputable brokers, institutions, and research firms around the world.

As of March 23, 2021, Jollibee (₱181.00) was trading above its estimated fair value (₱42.41) and is significantly overvalued. At the current price, the market expects Jollibee to grow future cash flows by more than what analysts expect per year for the next ten years.

Price to book ratio

The price to book ratio (PB) compares a company’s market value (share price x number of shares outstanding) to its book value (total assets - total liabilities).

Jollibee is overvalued based on its PB Ratio (2.9x) compared to the Philippine hospitality industry average (0.9x) and the market average (1.1x).

Conclusion

While currently unprofitable, Jollibee has been profitable on average for the past five years. Earnings are forecast to grow by an average of 91% per year for the next three years. The share price has been stable over the past three months. They have sufficient analyst coverage. No concerning events were detected. Shareholders have not been meaningfully diluted in the past year or recently listed. Revenue and market capitalization are meaningful. They do not have negative shareholders’ equity. However, debt is not well covered by operating cash flow.

Jollibee is currently overvalued. This indicates a high probability of undesirable returns from the current market price over time. The market is pricing in an excessively optimistic outlook, which limits investors’ upside potential.

The International Investor has no position in the company mentioned. This article is excerpted, edited, and sourced from the most recent company filings, analysts’ consensus, and Standard & Poor's Capital IQ. The content is for general informational and entertainment purposes only and should not be construed as financial advice.