Stocks fall, oil rises over increasing Russia-Ukraine tensions and inflation

Market update for the week ended February 11, 2022

Key takeaways

Stocks fall and oil rises as tensions between Russia and Ukraine increase.

Materials and energy are the top sectors in an inflation-focused week.

Market expectations on the probability of an increased size of the Fed’s first rate hike spikes.

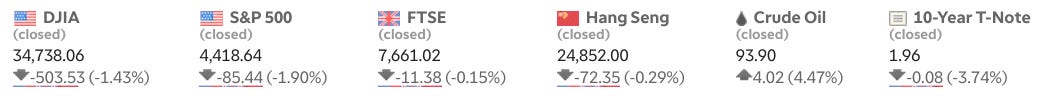

Stocks were unable to bounce back from Thursday’s sell-off. Stocks fell throughout the morning as rumors from the U.K. surfaced about increasing tensions with Russia. U.S. stocks started selling off going into the Friday lunch hour. During the afternoon trading session, a White House press briefing with White House National Security Advisor Jake Sullivan revealed that U.S. and some of its allies were concerned about Russia possibly invading Ukraine in the immediate future. In fact, Mr. Sullivan warned all Americans to leave Ukraine as soon as possible.

According to euronews, the U.K. and Norway joined the U.S. in urging their respective nationals to leave Ukraine immediately too. However, Ukraine appears to be downplaying the threat. Ukrainian Foreign Minister Dmytro Kuleba said that there was “nothing new” from the U.K. or the U.S.

According to Bloomberg, U.S. President Joe Biden and Russian President Vladimir Putin held an hour-long call today, Saturday, with Biden warning again of “severe costs” for any invasion of Ukraine and Putin accusing the U.S. of failing to provide him with the security assurances he needs to back down.

Tensions between Russia and the Ukraine have been ongoing. In 2021, Russia had been slowly accumulating troops in several locations about 250 kilometers or more outside the border. The troop movements have caused Ukrainian allies to try and push back against Russia.

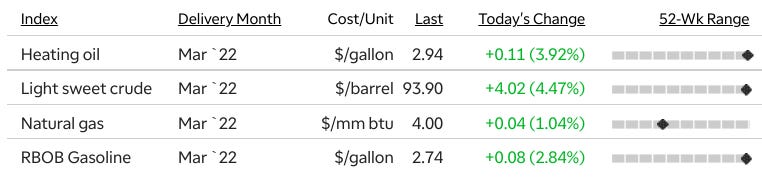

The tensions are likely a contributing factor to rising oil prices. One of the big issues in the Asia and Eastern European region is the building of oil pipelines. It’s no surprise that crude oil prices jumped on the news. Crude futures jumped up to $95 per barrel. However, prices pulled back to close at $93.90 for a change of 4.47%. Nonetheless, oil still closed at a new seven-year high.

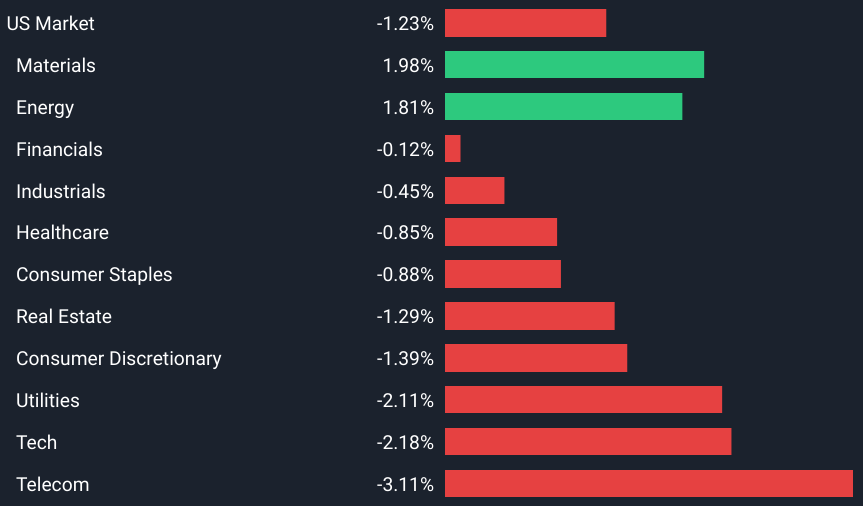

Over the past week, the U.S. stock market dropped 1.23%, driven by a pullback of 3.11% in the telecom sector. In the last 12 months, the market has been flat at +0.9% overall. Nevertheless, total earnings are forecast to grow by 13% annually.

Inflation-focused week

In a week that ended up being mostly about inflation, it’s probably no surprise that the inflationary U.S. sectors, including materials and energy, were top performers. These sectors were also the only sectors to finish in the green for the week. The materials sector topped the group, returning 1.98%. And the energy sector finished the week 1.81% higher.

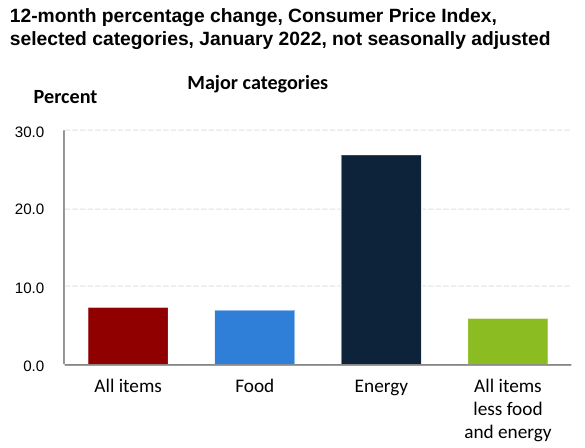

Thursday’s worse-than-expected U.S. Consumer Price Index (CPI) showed inflation grew 7.5% over the last 12 months — a pace that hadn’t been seen since 1982. Many economists are expecting to see inflation slow with the holiday shopping season behind us and supply chains opening. The Fed does have one more CPI report before it meets in March, which could give signs of slowing inflation that many are hoping for.

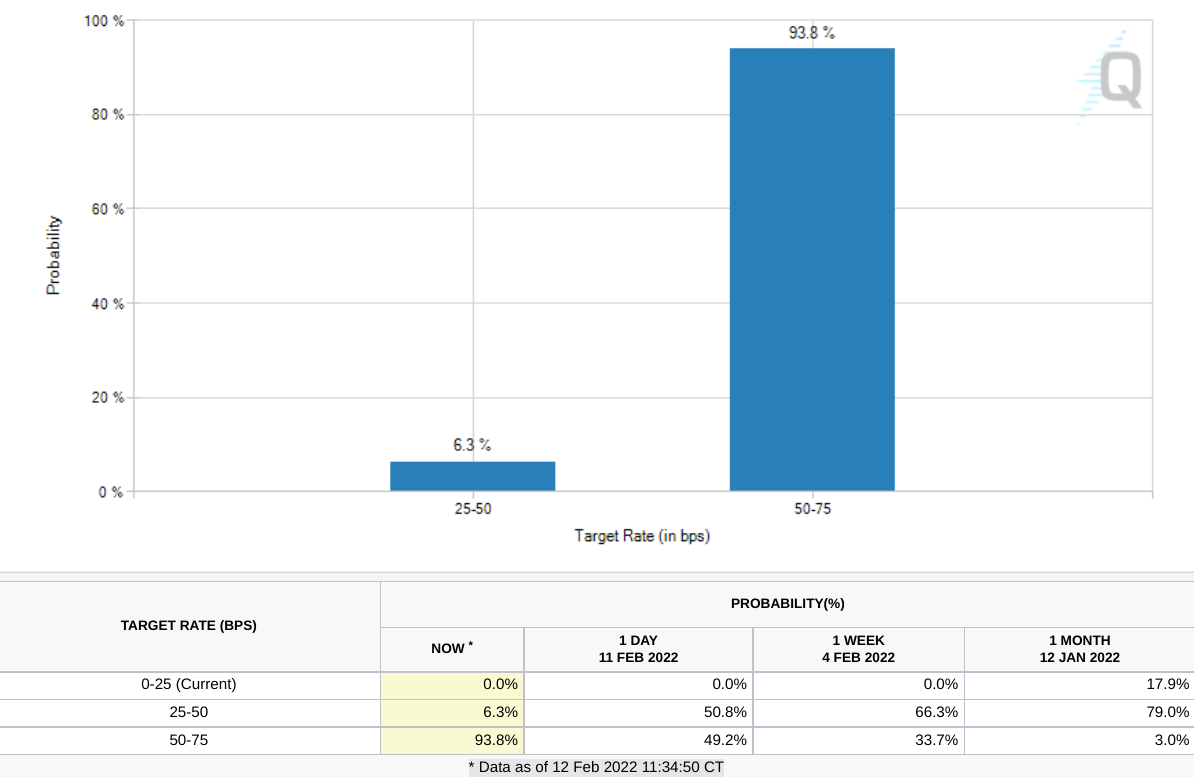

Fed target rate probabilities for March 16, 2022 Fed meeting

After Thursday’s CPI report, the CME FedWatch Tool spiked from 49% up to an almost 94% probability of a half-point or more (0.5% to 0.75%) rate hike by the Fed in March. This tool can vary day to day and likely has no bearing on the Fed’s decision, but it’s helpful in understanding what the markets are telling investors.

As stated above, the Fed has another CPI report before it meets in March, which could signal the slowing that many economists have been projecting. These probabilities will continue to change up or down as more information becomes available.

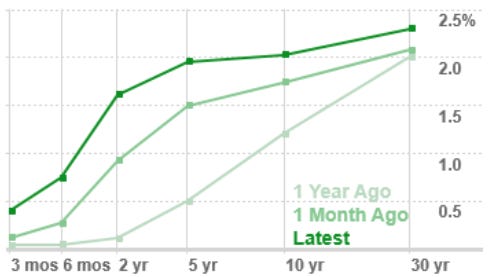

The 10-year U.S. Treasury yield was nearing 2.1% Friday and even inched up a little more in the morning, but has since pulled back below 2%, closing at 1.96% for the day. There had been some tension around the 10-year yield getting to 2%, so, perhaps the bond market can settle down now that the mark was met. Unfortunately, the tension around oil prices possibly reaching $100, due to the increasing Russia-Ukraine tensions, may make it hard on bond traders, and the 2-year Treasury yield was testing new highs on Friday.

Mar '22 light sweet crude and gasoline futures were all up over the past week of trading. Mar '22 light sweet crude futures were up $4.02, or 4.47%, to $93.90 a barrel in Nymex trading.

Outlook

Aside from the increasing Russia-Ukraine tensions, U.S. stocks, especially telecom and tech, came under pressure after the explosive inflation data, and many analysts are warning that the recent volatility could rise across all asset classes in case of a Fed policy mistake (acting too late, too strong, or not strong enough). However, should the Fed rate hikes successfully put a lid on price pressures this year, early losses could be followed by strong gains for stocks. In terms of the 10-year U.S. Treasury yield, the rate is likely to settle into a range between 2% and 2.5%, according to strategists at Morningstar and Neuberger Berman.

Have a profitable week ahead.

This post is excerpted, edited, and sourced from Bloomberg, Seeking Alpha, TD Ameritrade, and S&P Global Market Intelligence. The content is for general informational and entertainment purposes only and should not be construed as financial advice.