This is a developing story.

The merger

On October 15, 2021, Okada Manila, a casino resort operated by Tiger Resorts, Leisure & Entertainment Inc., entered into a merger agreement to acquire 26 Capital Acquisition Corp., a US special purpose acquisition company, from a group of shareholders.

(A special purpose acquisition company, or SPAC, is a “blank check” company that has no operations and is formed strictly to raise capital through an initial public offering, or IPO, for the purpose of acquiring or merging with an existing company.)

The merger values Okada Manila at an enterprise value of $2.6 billion and an equity value of $2.5 billion.

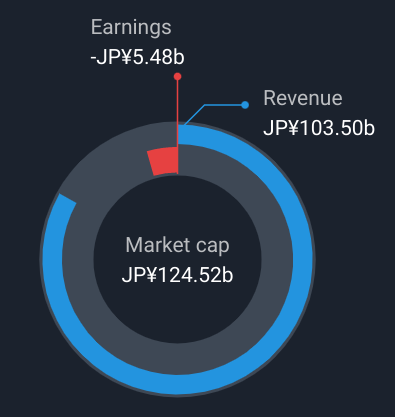

Universal Entertainment Corporation, Okada Manila’s publicly listed Japanese parent company and the current owner of 100% of its equity, will retain all its current holdings in Okada Manila in the new publicly traded company.

Universal Entertainment will roll 100% of its equity in the merger and is expected to own approximately 250 million shares, representing 87.9%, while 26 Capital public shareholders will own 9.7% of the combined company at closing, assuming no redemptions by 26 Capital shareholders.

Upon closing, the publicly traded company will have its common stock listed on Nasdaq through an American Depository Receipt (ADR) program.

Following the expected closing, Okada Manila will continue to be led by President Byron Yip, CFO Hans Van Der Sande, Kenshi Asano, President of UE Resorts International, Inc. (UERI), and Toji Takeuchi, Executive Officer and Head of Corporate Planning Division of Universal Entertainment and Board Member of UERI.

The board of directors will be composed of seven members, with at least two or three independent directors.

The deal may provide up to $275 million of cash to the business.

The parties have decided to change the company name to UE Resorts International, Inc. to focus their combined efforts on the future growth and development of Okada Manila, and their ambitions to establish a presence in other countries around the world.

After closing, UE Resorts International (formerly Okada Manila) will be listed on Nasdaq and 26 Capital will be delisted.

(The merger is subject to approval by 26 Capital stockholders, the Form F-4 and the Form F-6 shall have become effective, the reorganization, including the receipt of any approval of the BSP and any other governmental authority required, and shall have been completed, US regulatory approvals, Okada Manila common shares and Okada Manila warrants shall be approved for listing on Nasdaq, subscription dividend having been declared and distributed, completion of reorganization, and other customary closing conditions.)

The boards of directors of both 26 Capital and Okada Manila have unanimously approved the proposed transaction and recommend approval of the merger and share acquisition agreement, and related matters by the shareholders of 26 Capital.

Then…

The hostile takeover

On May 31, 2022, a group led by the 79-year old Japanese billionaire Kazuo Okada, who made his fortune by manufacturing pachinko slot machines and founded Universal Entertainment and his namesake Okada Manila property, stormed the casino in what became a headline-grabbing hostile takeover of its management and operations.

Okada says he was forced out of Universal Entertainment and Okada Manila in 2017 after the board, which included his estranged wife Takako Okada, accused him of stealing money from the company.

The Kazuo group reasoned that a “Status Quo Ante Order” (the state of affairs that existed previously), issued in April 2022 by the Philippine Supreme Court, justified its resumption of control.

The order allowed Okada Manila to restore its board composition to its previous 2017 structure. Okada Manila officials were forcibly removed from their corporate offices, and Kazuo has since claimed control over Okada Manila.

26 Capital CEO Jason Ader says Kazuo’s actions were illegal. He believes the raid will not impede 26 Capital and Okada Manila from moving towards its Nasdaq offering and Universal Entertainment will be back in control of the property soon.

Though Ader believes Kazuo has no rightful ownership claim to Okada Manila, the billionaire disagrees.

On June 6, 2022, the ousted board said it is suing Kazuo and his partners, including Filipino businessman Antonio “Tonyboy” Cojuangco, accusing them of coercion and other misconduct in what it said was a "violent and illegal" seizure of Okada Manila.

On June 9, 2022, the Kazuo group issued a statement claiming its actions were warranted. “Bottom line, there was nothing illegal,” a release from a Kazuo official stated. “Resort to force was reasonable and minimal.”

“Okada Manila, under the able leadership of Mr. Kazuo Okada, whom employees fondly call ‘Daddy O,’ is poised to seize the opportunity for business growth,” the Kazuo release concluded.

26 Capital CEO Ader added that the hostile takeover is not over ownership. He said Universal Entertainment owns Okada Manila, and Universal’s largest shareholder is Tomihiro Okada, Kazuo’s estranged son, who “is totally against his father’s actions.”

If it’s not over ownership, the Okada family feud is certainly all about the money…

The bet

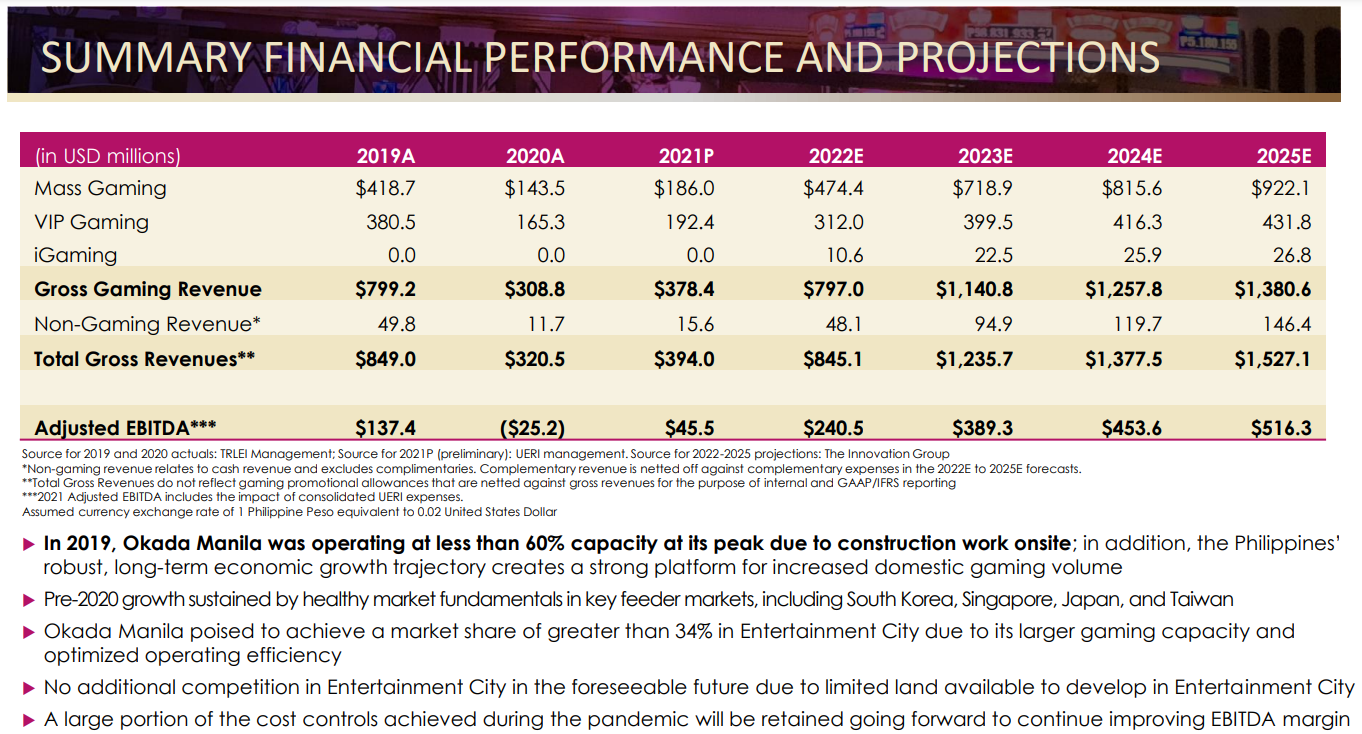

The merger is expected to close in the first half of 2022.

If it does, a quick and simple back-of-the-napkin calculation of Okada Manila’s potential equity value, based on its projected earnings and the US casinos and gaming industry 10-year median PE ratio of 26.4x, may be worth at least $6 billion to $14 billion.

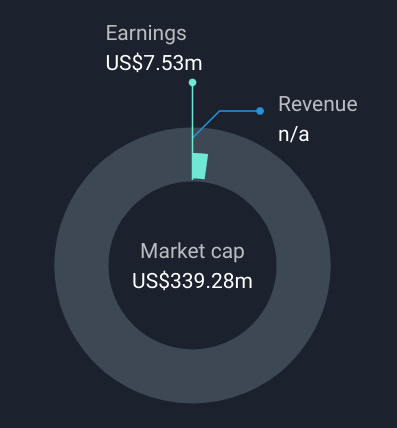

If it doesn’t, 26 Capital, according to SPAC rules, has two years to complete the merger or it must liquidate and return its funds (currently $339 million) to its investors.

If you believe that the merger will occur, you can buy a share or more of 26 Capital, which is currently trading at $9.87 on Nasdaq, and wait, while watching the legal fireworks and drama.

Who feels lucky? Place your bets.

The author does not own shares of any of the above-mentioned companies. He enjoys analyzing and estimating the true or intrinsic value of businesses. This post is excerpted, edited, and sourced from 26 Capital Acquisition, Okada Manila, Universal Entertainment, company filings, and S&P Global Market Intelligence. The content is for general informational and entertainment purposes only and should not be construed as investment advice.