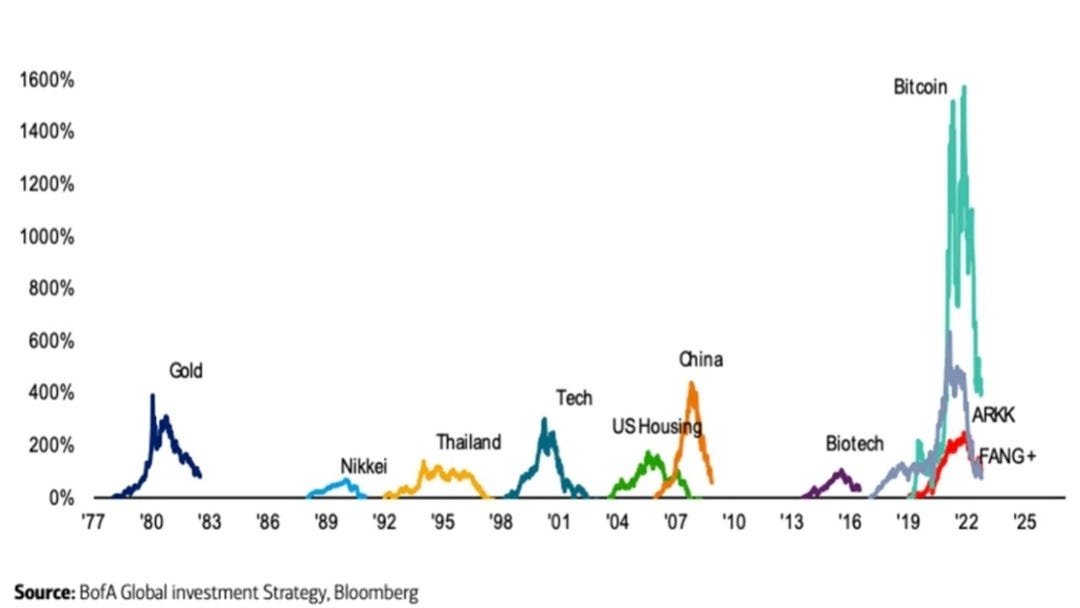

The Historic Crypto Bubble

Bitcoin is the fifth largest crash in the past 50 years!

“When prices go up enough, everybody believes something, even if it is only that everybody else is just about to believe.”

— Adam Smith, The Money Game

“I know that bubbles have always happened and they always look the same, it is the damnedest thing. People always say the same things in bubbles: ‘This new technology is going to change the world,’ or ‘You don't understand what is going on, you old fogey.’ All those same things have been trotted out in every bubble in history, whether it is commodities, tankers, or bonds. People always get just as hysterical. The smart money always loses money shorting them because they cannot comprehend that it could go as high as it does.”

“What I want to remind you to remember is that bubbles burst in the wake of hysteria, while plummeting prices usually end in panic.”

— Jim Rogers (During the 1970s, his Quantum Fund grew 4,200%, while the S&P 500 rose less than 47%.)

The best way to protect ourselves from economic and geopolitical uncertainty (including bubbles) is to invest in high quality, cash generating businesses over the long term, that deliver real value to the economies they serve.

The International Investor provides profitable investment intelligence and manages a hedge fund for a select group of individuals, their families, and the foundations and companies they lead. The fund invests in the world’s highest quality businesses, with high and sustainable returns on capital, at attractive prices and margins of safety to what they're intrinsically worth. The fund compounds superior value over time, with minimum risk, regardless of the global market environment.

The content is for informational purposes only and is neither an offer to buy or sell securities nor investment advice. Forward-looking statements may be uncertain and historical returns may not predict future performance. The International Investor is not a registered broker-dealer, investment adviser, or fiduciary.