Once upon a time, in the early 2000s, China experienced a period of rapid economic growth and prosperity following its accession to the World Trade Organization (WTO), with GDP, or economic output, consistently exceeding 10% per year and a surge in foreign investment and exports. However, geopolitical challenges have since dimmed this dream of a global village.

Yet, in China’s neighboring country, Vietnam, a similar story of remarkable economic growth has unfolded, surpassing even that of China. Vietnam’s journey began after the Vietnam War, where the nation was under a U.S. trade embargo until 1994.

The chart below shows that, in 1994, Vietnam was second to last in Southeast Asia’s GDP per person.

Facing economic challenges, Vietnam initiated “Đổi Mới,” a series of reforms that opened up its economy, embraced trade, and attracted foreign investments.

Vietnam quickly transitioned from being one of the world’s poorest nations to achieving middle-income status, increasing 18.5 times, or 1,753%, or 11% per year in GDP per person over 28 years after 1994.

The chart below shows that, in 2022, Vietnam leapfrogged to sixth in Southeast Asia’s GDP per person.

This remarkable transformation was driven by three waves of foreign investment: first from companies like Honda and global sportswear brands, followed by tech firms in the early 2000s, and later by foreign retail businesses, such as Aeon.

As a result, Vietnam has become a significant export powerhouse, producing a substantial portion of global products, including more than half of Nike’s shoes and 60% of Samsung’s phones. Samsung has played a significant role, employing over 100,000 people and accounting for an impressive 18% of all Vietnamese exports. Notably, Vietnam’s competitiveness arises from lower labor costs and the quality of its workforce.

The chart below shows that, since 2010, Vietnam’s average monthly labor costs have remained the most competitive.

Vietnam’s attractiveness to investors is further accentuated by its intent to shift from labor-intensive industries towards more profitable sectors like semiconductors, reflecting the growing trend to diversify supply chains away from China. Despite challenges such as limitations on foreign ownership, the country’s success is undeniable.

The nation’s pursuit of high-income status by 2045 requires sustained growth rates of at least 7%, a goal that becomes more challenging as it moves beyond low-hanging fruit and seeks to build a richer society. However, Vietnam’s investment in education stands out, with students having the second-longest learning-adjusted years of schooling in Southeast Asia, second only to Singapore. The country’s human capital index is also the highest among lower-middle-income economies.

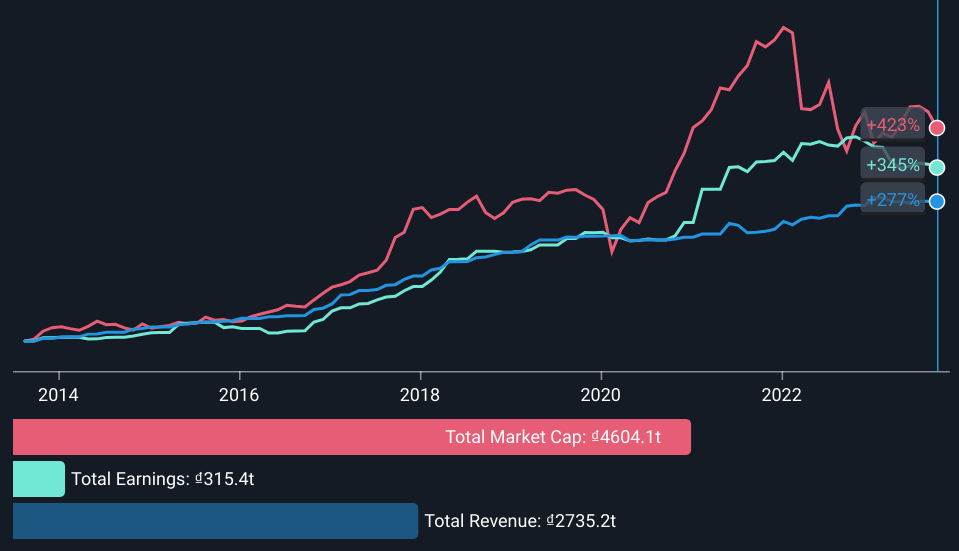

Vietnam shines in the region with impressive business growth figures. The chart and statistics below show that, over the past decade, the country has seen a remarkable 423% increase in market value, accompanied by a 345% rise in earnings and a 277% boost in revenue, marking the highest growth rates in the region.

10-year earnings growth:

Vietnam: 345%

Indonesia: 150%

Philippines: 98%

Singapore: 19%

Thailand: 15%

Malaysia: -9%

These statistics reflect the overall surge in sales and profitability among Vietnamese companies. Looking ahead, Vietnam is expected to continue its strong performance with an anticipated annual earnings growth rate of 23%, maintaining its position as the regional leader in business expansion.

While Vietnam’s market remains under-the-radar for many foreign investors due to its classification as a “frontier market” by Morgan Stanley Capital International, or MSCI, the nation’s potential for an upgrade to an “emerging market” offers a promising future, potentially attracting substantial inflows.

In summary, Vietnam’s economic success story, reminiscent of China’s early 2000s boom, showcases the nation’s potential and opportunities for investors, and highlights lessons for business decision makers and economic policymakers.