The World's Largest Flower Market, Cocoa's 65-Year Price High, and Southeast Asian Investment Returns for the Week Ended May 10, 2024

Happy Mother’s Day!

According to surveys, flowers are the most popular Mother’s Day gift, followed by chocolate, gift cards, dinner, jewelry, and beauty products.

Speaking of flowers, did you know that Royal FloraHolland operates the world’s largest flower market and auction? Based in the Netherlands, it plays a crucial role in the global flower industry by providing a marketplace where flower growers can sell their products to buyers from all over the world. In 2023, it made over five billion euros in flower sales. The auction process is highly efficient and transparent, enabling growers to reach a wide range of customers and buyers to access a vast selection of flowers and plants. Additionally, it offers various services to its members, including logistics, quality control, and market information, to support the smooth functioning of the flower trade.

Discover Royal FloraHolland’s story in a one-minute video below that explains who they are, what they do, and what they aim to achieve for their members, growers, buyers, and the global flower industry. Discover their trade center, which is a unique horticultural must-see. Every year, thousands of visitors tour their global marketplace. When you are visiting Amsterdam, make sure to plan a trip to this extraordinary place in Aalsmeer.

Chocolate, the second-most popular Mother’s Day gift, has become the new gold. The chart below shows that the price of its main ingredient, cocoa, has skyrocketed 187% over the past year and has hit a record high, soaring to US$9,300 per tonne, the highest since 1959. This surge comes as global cocoa supplies remain tight, leading to concerns about shortages. The shortage is largely due to poor harvests in West Africa, the main cocoa-growing region, with the world facing a third straight year of deficit.

Move over gold, cocoa’s the new currency in town! Who needs bars when you can have chocolate?

Top Business Returns

Which business has been the price return leader in each Southeast Asian market over the past week? Which are undervalued and selling at more than 20% discounts to their fair values?

Malaysia

Eversendai Corporation Berhad provides turnkey structural steel works for high-rise buildings, composite structures, long span and roof structures, bridges, and industrial plants in Southeast Asia, India, the Middle East, and Morocco.

The company’s share price of RM0.61 is up 57.7% from RM0.39 on May 3, 2024. It outperformed the Malaysian market, which is up 1.1% over the past seven days. It also outperformed the Malaysian construction industry, which is up 2.3% over the same period.

The company’s share price is fairly valued, selling at a 4.1% premium, which is within ± 20% of its estimated fair value of RM0.59.

Singapore

Great Eastern Holdings Limited, an investment holding company and subsidiary of Oversea-Chinese Banking Corporation, provides insurance products in Singapore, Malaysia, and the rest of Asia.

The company’s share price of S$25.72 is up 40.5% from S$18.30 on May 3, 2024. It outperformed the Singaporean market, which is up 0.6% over the past seven days. It also outperformed the Singaporean insurance industry, which is up 2.7% over the same period.

The company share price is undervalued, selling at a 35.7% discount to its estimated fair value of S$40.00.

Indonesia

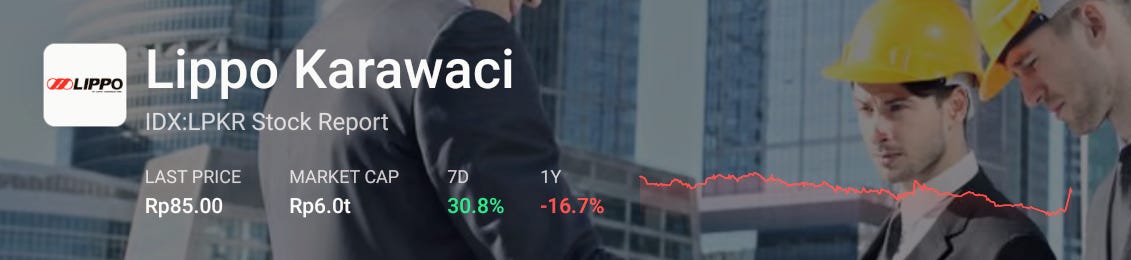

PT Lippo Karawaci Tbk, together with its subsidiaries, provides property development services in Indonesia.

The company’s share price of Rp85.00 is up 30.8% from Rp65.00 on May 3, 2024. It outperformed the Indonesian market, which is down 0.8% over the past seven days. It also outperformed the Indonesian real estate industry, which is down 0.05% over the same period.

The company’s share price is undervalued, selling at an 81.1% discount to its estimated fair value of Rp450.00 and a 34.6% discount to its one-year analyst price projection of Rp130.00.

Vietnam

CMC Corporation, together with its subsidiaries, engages in the provision of information technology and other services relating to computers in Vietnam and internationally.

The company’s share price of ₫58,900 is up 30.6% from ₫45,100 on May 3, 2024. It outperformed the Vietnamese market, which is up 1.9% over the past seven days. It also outperformed the Vietnamese information technology industry, which is up 5.5% over the same period.

The company’s share price is overvalued, selling at a 1,741% premium to its estimated fair value of ₫3,200 and a 35.7% premium to its one-year analyst price projection of ₫43,400.

Philippines

Atok-Big Wedge Co., Inc., together with its subsidiaries, engages in the exploration and development, and mining of oil and gas, and other natural resource properties in the Philippines.

The company’s share price of ₱4.00 is up 27.4% from ₱3.14 on May 3, 2024. It outperformed the Philippine market, which is down 0.6% over the past seven days. It also outperformed the Philippine metals and mining industry, which is up 4.2% over the same period.

The company’s share price is fairly valued, selling at a 9.3% premium, which is within ± 20% of its estimated fair value of ₱3.66.

Thailand

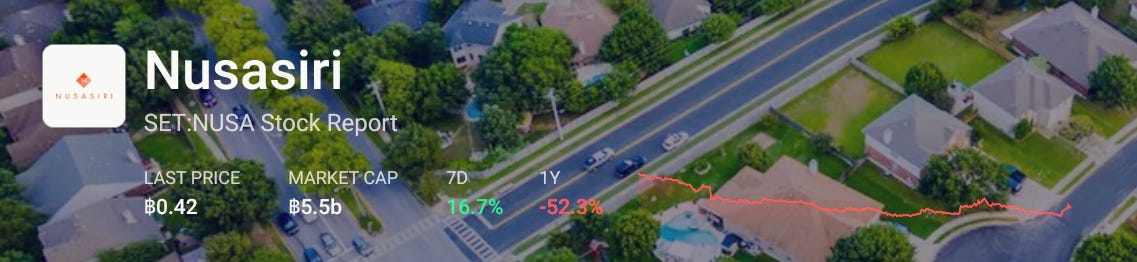

Nusasiri Public Company Limited engages in the property development business in Thailand.

The company’s share price of ฿0.42 is up 16.7% from ฿0.36 on May 3, 2024. It outperformed the Thai market, which is up 0.1% over the past seven days. It also outperformed the Thai real estate industry, which is down 1.2% over the same period.

The company’s share price is overvalued, selling at a 31.3% premium to its estimated fair value of ฿0.32.

Year-to-Date Market Price Returns as of May 10, 2024

Which Southeast Asian markets have been the price return leaders and laggards since the start of 2024?

🟢 Malaysia: +11.2%

🟢 Vietnam: +8.8%

🟢 Myanmar: +1.5%

🟢 Indonesia: +1.0%

🟢 Philippines: +0.3%

🟢 Laos: +0.06%

🔴 Singapore: -0.007%

🔴 Thailand: -4.4%

🔴 Cambodia: -12.3%

How do they compare to other markets’ price returns since the start of 2024?

🟢 Hong Kong: +15.8%

🟢 Taiwan: +14.9%

🟢 Gold: +14.6%

🟢 Japan: +12.9%

🟢 Oil (WTI): +12.9%

🟢 United States: +9.3%

🟢 Europe Stock Market Average: +7.9%

🟢 India: +7.9%

🟢 World Stock Market Average: +7.5%

🟢 Commodities: +6.2%

🟢 Emerging Stock Market Average: +5.6%

🟢 Australia: +1.8%

🟢 South Korea: +1.4%

🟢 China: +0.03%

🔴 Emerging Market Currencies to USD: -0.5%

🔴 Global Bonds: -3.4%