The world's top 100 artists saw a 609% increase in value since 2000

The art market is an alternative investment opportunity that is both exciting and profitable, and an option worth considering.

In 2018, art research firm Artprice came up with an index called the Artprice 100. Unlike other indices, this one only focuses on the most stable artists in the global art market, also known as “blue chip” artists. This means the index ignores the impact of unreliable elements like fashion and speculation on the prices of other artists. The goal of the Artprice 100 index is to track and measure the growth of the art market over time by looking at its most reliable elements.

The Artprice 100 index is a useful tool for investors, financial institutions, and private bankers who are looking for reliable investment opportunities without needing to know much about the art market. It acts as a benchmark that can be compared to other major stock market indices like the US’s S&P 500, the UK’s FTSE 100, France’s CAC, and Hong Kong’s Hang Seng.

In short, the Artprice 100 index is a response to the demand for a reliable benchmark of the art market, which is considered an alternative investment option. By focusing on the most important and fundamental artists, the index provides an accurate representation of the art market’s value.

Starting from January 1st, 2000, the Artprice 100 index simulates an investment in the top 100 artists who have the most consistent and highest auction results from the previous five years. The index is not altered throughout the rest of the year, so its overall value changes based on the individual performance of each artist in the portfolio, taking into account their weight (see list of artists below).

The Artprice 100 index is all about money and art, and it doesn’t change the non-financial connection between collectors and artists. The index shows what would happen if you invested in the world’s top-selling artists to make a profit from their success. It’s a benchmark for the art market, a theoretical simulation of investing in the 100 most successful artists without any personal or aesthetic biases.

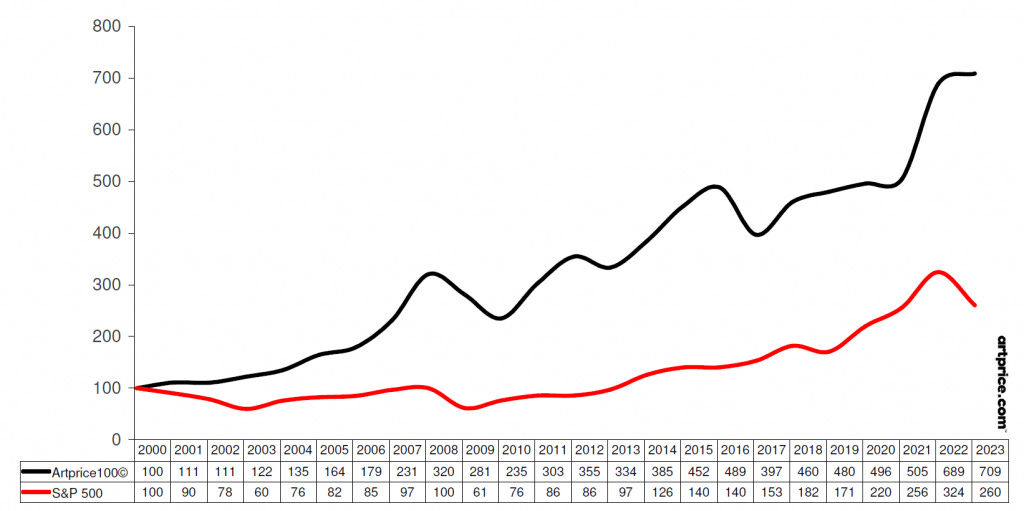

Investing $100 in the Artprice 100 index at its launch in 2000, would have been worth $709 by January 31, 2023 — yielding an impressive annualized return of 8.9% over the years. The Artprice 100 index has outperformed the S&P 500 stock market index, with a $100 investment in the S&P 500 index in 2000 only growing to $260 by January 31, 2023 — earning a yearly return of 4.2%.

Over the past year, the Artprice 100 index saw a rise of 2.9%, surpassing the S&P 500's decline of 19.8%.

The year 2022 was a challenging one globally with the ongoing economic effects of the Covid-19 pandemic, supply chain disruptions, and the war in Ukraine. Most asset classes saw significant declines in value and the NFT market slowed due to the decline in the prices of cryptocurrencies. Despite these setbacks, the global art auction market had a successful year and one of the best in history. American auction houses posted record sales in paintings, photography, and tapestry, and strong results in France, Germany, and Hong Kong helped stabilize the market.

In recent years, the Asian art market has been booming, with new hotspots popping up all over the region.

The Philippines stands out as the only Southeast Asian country in the top 15 for contemporary art auction sales and market share in 2021-2022. Meanwhile, South Korea’s contemporary art auction sales reached a stunning $66 million, almost matching France’s. Seoul in particular saw a massive 344% growth in contemporary art sales and is now cementing its status as one of the world’s new hubs for contemporary art. The city has even overtaken Tokyo, despite the latter’s impressive 55% growth in the segment.

There was intense competition for masterpieces from the most prestigious collections, including the Givenchy, Ammann, Maezawa, and Allen collections. The year’s results also showed a continued strong demand for works by young artists.

While gaining almost 3% in value over the past year, the Artprice 100 index may not seem to have had a strong performance compared to the amazing headline results for top artists. However, this index takes into account all the sales from the 100 top-selling and most in-demand artists, and some of their works didn’t sell as well as others.

For example, the third best sale of the year was Paul Cézanne’s “La Montagne Sainte-Victoire” from 1888-1890, which was bought in 2001 for $38.5 million and sold for $137.8 million in 2022 as part of the Paul G. Allen Collection.

But a few days later, another Cézanne painting, “Maisons au Chou, à Pontoise” from around 1881, bought in 2007 for $6.8 million, only sold for $3.7 million at a Christie’s auction in New York. Despite economic challenges, blue chip artists still saw a slight increase in market value, with the rarest masterpieces by these top artists seeing the best returns.

In conclusion, the Artprice 100 index offers investors a reliable and consistent benchmark for the global art market. With a history of outperforming the major stock market indices, the art market provides an attractive alternative investment opportunity for those seeking to diversify their portfolio. The index proves that artists with a proven track record of consistent and high auction results, offers stability and reduces the impact of unreliable elements. The recent growth of the Asian art market and the continued demand for works by young artists show a bright future for the art market. Despite some volatility over the past year, the Artprice 100 index’s 2.9% increase in value speaks to the art market’s resilience in uncertain times. An investment of $100 in the Artprice 100 index at its launch in 2000 would have grown to $709 by January 31, 2023, yielding an impressive annualized return of 8.9%. If you are looking for an alternative investment opportunity that is both exciting and profitable, the art market is an option worth considering.

The Artprice 100 Index: Artist + 2022 Portfolio Weighting

Pablo PICASSO (1881-1973). 8.6%

Jean-Michel BASQUIAT (1960-1988). 4.4%

Andy WARHOL (1928-1987). 4.2%

Claude MONET (1840-1926). 4.0%

ZAO Wou-Ki (1921-2013). 3.8%

QI Baishi (1864-1957). 2.8%

Gerhard RICHTER (1932-). 2.6%

FU Baoshi (1904-1965). 2.2%

WU Guanzhong (1919-2010). 2.1%

David HOCKNEY (1937-). 2.1%

Yayoi KUSAMA (1929-). 1.9%

Roy LICHTENSTEIN (1923-1997). 1.7%

René MAGRITTE (1898-1967). 1.7%

Vincent VAN GOGH (1853-1890). 1.7%

Cy TWOMBLY (1928-2011). 1.7%

Alberto GIACOMETTI (1901-1966). 1.6%

SAN Yu (1895/1901-1966). 1.6%

Alexander CALDER (1898-1976). 1.5%

Marc CHAGALL (1887-1985). 1.5%

Willem DE KOONING (1904-1997). 1.4%

Joan MIRO (1893-1983). 1.4%

Yoshitomo NARA (1959-). 1.3%

CUI Ruzhuo (1944-). 1.3%

Jean DUBUFFET (1901-1985). 1.2%

Lucio FONTANA (1899-1968). 1.1%

BANKSY (1974-). 1.1%

Amedeo MODIGLIANI (1884-1920). 1.1%

Joan MITCHELL (1925-1992). 1.1%

Henri MATISSE (1869-1954). 1.0%

Fernand LEGER (1881-1955). 1.0%

Wassily KANDINSKY (1866-1944). 1.0%

Paul CEZANNE (1839-1906). 1.0%

Ed RUSCHA (1937-). 0.9%

Pierre-Auguste RENOIR (1841-1919). 0.9%

CHU Teh-Chun (1920-2014). 0.9%

Peter DOIG (1959-). 0.9%

George CONDO (1957-). 0.8%

PAN Tianshou (1897-1971). 0.8%

Christopher WOOL (1955-). 0.8%

Franois-Xavier LALANNE (1927-2008). 0.8%

KAWS (1974-). 0.7%

LIN Fengmian (1900-1991). 0.7%

Jeff KOONS (1955-). 0.7%

Pierre SOULAGES (1919-2022). 0.7%

Henry MOORE (1898-1986). 0.6%

Frank STELLA (1936-). 0.6%

Keith HARING (1958-1990). 0.6%

Edgar DEGAS (1834-1917). 0.6%

Camille PISSARRO (1830-1903). 0.6%

Robert RAUSCHENBERG (1925-2008). 0.6%

Paul GAUGUIN (1848-1903). 0.6%

PU Ru (1896-1963). 0.6%

Morton Wayne THIEBAUD (1920-2021). 0.6%

ZHOU Chunya (1955-). 0.6%

Richard PRINCE (1949-). 0.5%

Sigmar POLKE (1941-2010). 0.5%

ZENG Fanzhi (1964-). 0.5%

Louise BOURGEOIS (1911-2010). 0.5%

Rudolf STINGEL (1956-). 0.5%

Damien HIRST (1965-). 0.5%

Paul SIGNAC (1863-1935). 0.5%

Constantin BRANCUSI (1876-1957). 0.5%

LIU Ye (1964-). 0.5%

Tsuguharu FOUJITA (1886-1968). 0.4%

Georgia O’KEEFFE (1887-1986). 0.4%

Georg BASELITZ (1938-). 0.4%

Auguste RODIN (1840-1917). 0.4%

Whan-Ki KIM (1913-1974). 0.4%

Salvador DALI (1904-1989). 0.4%

Fernando BOTERO (1932-). 0.4%

Ufan LEE (1936-). 0.4%

Nicolas DE STAL (1914-1955). 0.4%

Jasper JOHNS (1930-). 0.4%

Ernst Ludwig KIRCHNER (1880-1938). 0.4%

Adrian GHENIE (1977-). 0.4%

Norman Perceval ROCKWELL (1894-1978). 0.4%

Bernard BUFFET (1928-1999). 0.4%

Albert OEHLEN (1954-). 0.4%

Sam FRANCIS (1923-1994). 0.4%

Helen FRANKENTHALER (1928-2011). 0.3%

ZHANG Xiaogang (1958-). 0.3%

Donald JUDD (1928-1994). 0.3%

DONG Qichang (1555-1636). 0.3%

WU Hufan (1894-1968). 0.3%

Takashi MURAKAMI (1962-). 0.3%

Brice MARDEN (1938-). 0.3%

Agnes MARTIN (1912-2004). 0.3%

Egon SCHIELE (1890-1918). 0.3%

Pierre BONNARD (1867-1947). 0.3%

Kazuo SHIRAGA (1924-2008). 0.3%

Yves KLEIN (1928-1962). 0.3%

Tamara DE LEMPICKA (1898-1980). 0.3%

Francis PICABIA (1879-1953). 0.3%

Max ERNST (1891-1976). 0.3%

Gustav KLIMT (1862-1918). 0.3%

Ellsworth KELLY (1923-2015). 0.3%

Jean-Paul RIOPELLE (1923-2002). 0.3%

Robert MOTHERWELL (1915-1991). 0.3%

WEN Zhengming (1470-1559). 0.3%

Tom WESSELMANN (1931-2004). 0.3%

The best way to compound wealth, while protecting ourselves from economic and geopolitical uncertainty, is to invest in high quality, cash generating businesses over the long term, that deliver real value to the economies they serve.

The International Investor provides profitable investment intelligence. We help investors and business managers make informed decisions by providing facts, insights, trends, and analytics.

We manage a hedge fund for a select group of individuals, their families, and the foundations and companies they lead. The fund invests in the world’s highest quality businesses, with high and sustainable returns on capital, at attractive prices and margins of safety to what they're intrinsically worth. The fund compounds superior value over time, with minimum risk, regardless of the global market environment.

The content is for informational purposes only, and is neither an offer to buy or sell securities nor investment advice. Forward-looking statements may be uncertain and historical returns may not predict future performance. The International Investor is not a registered broker-dealer, investment adviser, or fiduciary.