Foreign Direct Investment (FDI) is a crucial economic phenomenon where an individual or business entity from one country invests directly in productive assets or enterprises in another country. This investment typically involves acquiring a substantial ownership stake, allowing the foreign investor to have a significant influence on the management and operations of the invested entity. FDI matters for several reasons. Firstly, it fosters economic growth by providing capital for development, creating jobs, and transferring technology and expertise. Secondly, it facilitates global economic integration, encouraging collaboration between nations. Additionally, FDI often brings in new management practices and innovation, enhancing the efficiency and competitiveness of domestic industries. Lastly, it serves as a barometer of a country’s attractiveness to international investors, reflecting the perceived stability, growth potential, and business-friendly environment, thus influencing a nation’s global standing and economic prosperity.

Over the span of 35 years, Vietnam’s FDI has undergone a remarkable transformation, surging 25% per year from a modest US$7.7 million in 1988 to an impressive US$17.9 billion in 2022, exceeding Malaysia (US$14.7 billion), Thailand (US$10.2 billion), and the Philippines (US$9.2 billion).

FDI annual growth rates from 1988 to 2022:

Vietnam: 24.8%

Indonesia: 10.9%

Malaysia: 9.0%

Philippines: 6.8%

Thailand: 6.6%

As of the close of 2022, more than 36,000 FDI businesses were actively shaping Vietnam’s economic landscape since 1990. Notably, 57% of these committed funds have already been disbursed.

The FDI narrative in Vietnam commenced in 1988 with its inaugural project in the southern province of Ba Ria – Vung Tau. However, in the initial years, foreign investors displayed caution, resulting in a gradual influx of projects and capital.

First wave

By 1991, a pivotal turning point arrived as FDI growth accelerated, ushering in the first substantial wave of foreign investment. Industry titans such as Taiwanese footwear giants Pou Chen (the world’s largest manufacturer of Nike, Adidas, Asics, Clark’s, Reebok, Puma, New Balance, Crocs, Merrell, Timberland, Converse, and Salomon) and Feng Tay (another large manufacturer of Nike), along with Japan’s Honda, established their manufacturing foothold in Vietnam. The subsequent 1997 Asian financial crisis cast a chill over the FDI market, taking until 2002 to regain momentum.

Second wave

The year 2006 witnessed a resurgence with billion-dollar investments from American chipmaker Intel and South Korean steel manufacturer Posco, marking the second significant FDI wave, totaling a record-breaking US$2.4 billion. By 2008, Vietnam reached new heights with FDI of US$9.6 billion, coinciding with the initiation of Samsung’s first factory in Bac Ninh Province.

The aftermath of the global financial crisis of 2008 disrupted Vietnam’s FDI landscape, leading to significantly lower funds fluctuating around US$8-9 billion from 2009 to 2014.

Third wave

From 2014 to 2019, FDI experienced a steady comeback, surging from US$9.2 billion in 2014 to US$16.1 billion in 2019, constituting the third major wave of foreign capital. However, the onset of the 2020 Covid-19 pandemic temporarily halted cross-border investments, causing a drop in FDI to US$15.7 billion in 2021.

Fourth wave

After 35 years, South Korea, Singapore, and Japan emerged as the top contributors to Vietnam’s FDI, with the U.S. notably absent from the top 10.

This is expected to change with the upgraded Comprehensive Strategic Partnership between Vietnam and the U.S. in September 2023, which promises a substantial fourth wave of FDI from the world’s largest economy.

Multiplying effects

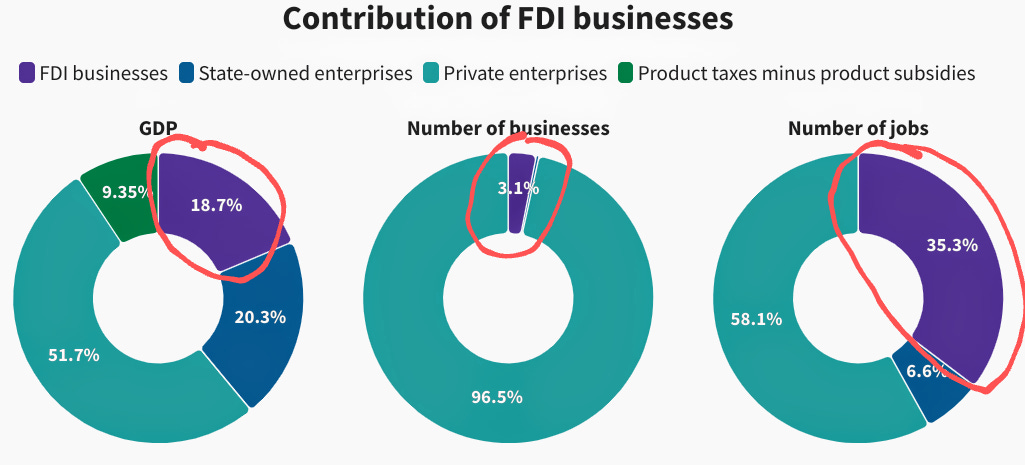

Currently, FDI contributes 19% to Vietnam’s GDP, employing 35% of the labor force despite representing only 3% of businesses.

FDI plays a pivotal role in the country’s economic growth, especially in the export sector, where it now dominates six out of eight main commodities with sales exceeding US$10 billion.

Furthermore, FDI businesses, comprising 98% of exports in high-tech products, demonstrate greater efficiency compared to the domestic sector. The FDI sector has outperformed the public and private sectors in growth and earning power for a significant portion of the years from 2005 to 2021.

The enduring impact of FDI extends beyond economic metrics, symbolizing Vietnam’s enhanced international collaboration and elevated global standing. As noted by Phan Huu Thang, former director general of the Ministry of Planning and Investment’s Foreign Investment Agency (FIA), FDI has not only contributed technological and management expertise but has also catalyzed the development of Vietnamese businesses across various fields, including real estate, energy, transport, and IT.

Insights for investors and policymakers

Investors and policymakers can glean several critical insights from the trajectory of Vietnam’s FDI evolution. Firstly, fostering a conducive business environment and addressing regulatory barriers is imperative for attracting and sustaining FDI.

The phased approach taken by Vietnam, marked by policy adjustments and openness to foreign investors, played a pivotal role in its FDI success. Business decision makers and policymakers should also recognize the cyclical nature of FDI, preparing for economic downturns and implementing strategies to mitigate their impact. Furthermore, prioritizing technology transfer and innovation through FDI can contribute to long-term economic growth and competitiveness. Finally, cultivating strategic international partnerships, as exemplified by Vietnam’s collaboration with South Korea, Singapore, and Japan, and now the U.S., underscores the significance of diplomatic relations in attracting substantial foreign investments.