Vietnam's Stock Market Accounts Surge: Record 7.94 Million and Counting

Dear Investors,

Vietnam’s stock market accounts surged to an all-time high of 7.94 million in May 2024, according to the Vietnam Securities Depository and Clearing Corporation.

An average of 4,265 new accounts were opened daily during the month, marking the sixth consecutive month of growth and surpassing the previous record of 7.82 million accounts set in September 2023.

The record increase in stock market accounts underscores a significant rise in Vietnamese wealth and financial literacy. It reflects a growing middle class with disposable income and a keen interest in investment opportunities, indicating robust economic growth and a more dynamic financial sector. This surge in new accounts suggests that Vietnamese people and investors are increasingly confident in the country’s economic prospects and are actively seeking to capitalize on the stock market’s potential returns, contributing to the overall vibrancy and resilience of the Vietnamese economy.

The Vietnamese stock market has already experienced a 12% growth in value since the start of this year, roughly matching last year’s 11% overall gain. Analysts are expecting an overall gain of about 18% by the end of the year.

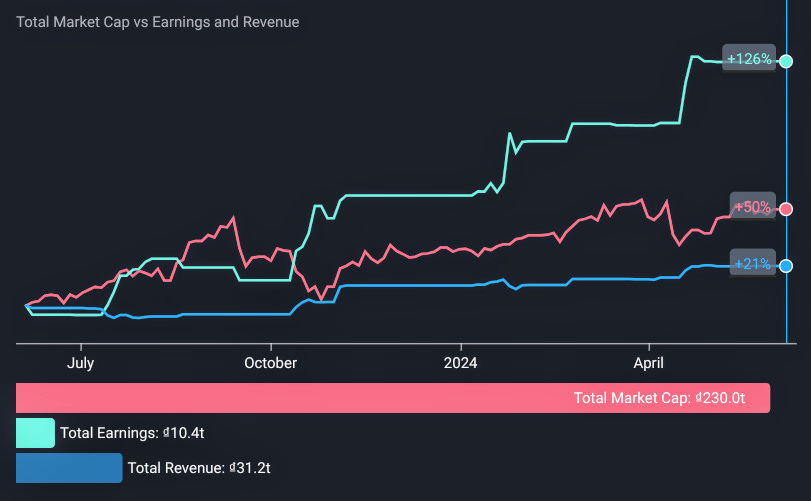

The earnings and revenue of the 28 publicly-listed Vietnamese securities brokerage firms surged by 126% and 21%, respectively, over the past year, while their market values also grew by 50%.

Here are the top five securities brokerage firms with the highest earnings growth over the past year that drove the industry’s 126% earnings growth:

Thien Viet Securities: +3,391%

BOS Securities: +2,049%

BIDV Securities: +317%

VNDIRECT Securities: +235%

Ipa Investments Group: +228%

As of the latest data, Vietnam now has the second-highest number of stock market accounts among ASEAN-6:

Indonesia: 12.2 million (source)

Vietnam: 7.9 million (source)

Thailand: 5.9 million (source)

Malaysia: 4.0 million

Singapore: 2.5 million

Philippines: 1.9 million (source)

Insight: Common stock investments have helped make nations prosperous and powerful. Owning a share in a nation’s economy is like owning a share in a nation’s future.

I hope that you found the above insightful and useful.

I wish you profitable returns on your capital.

Eric, The International Investor