Global Investors Flock to Southeast Asia as Markets Outperform

Southeast Asian stocks have become a top choice for global investors as they anticipate US interest rates to fall.

Stock prices tend to rise when interest rates fall because lower interest rates reduce borrowing costs for companies, making it cheaper for them to finance growth, expand operations, and invest in new projects. This can lead to higher future earnings, which attracts investors. Additionally, lower interest rates make bonds and savings accounts less attractive, driving investors toward stocks for better returns.

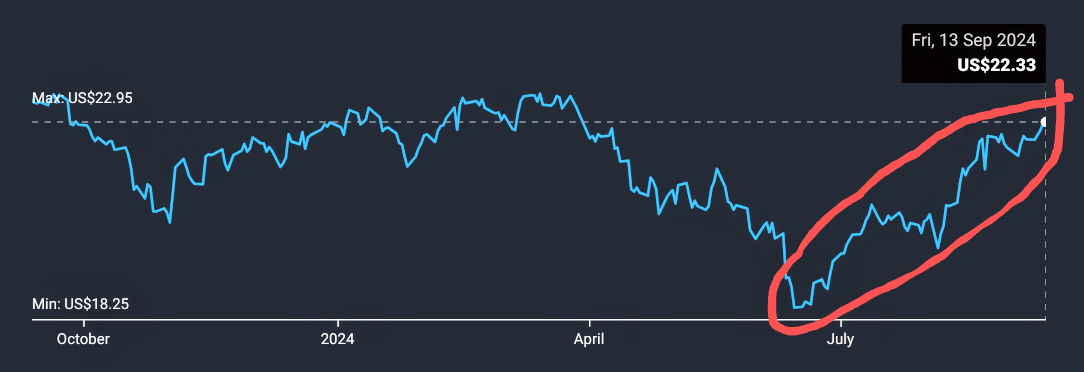

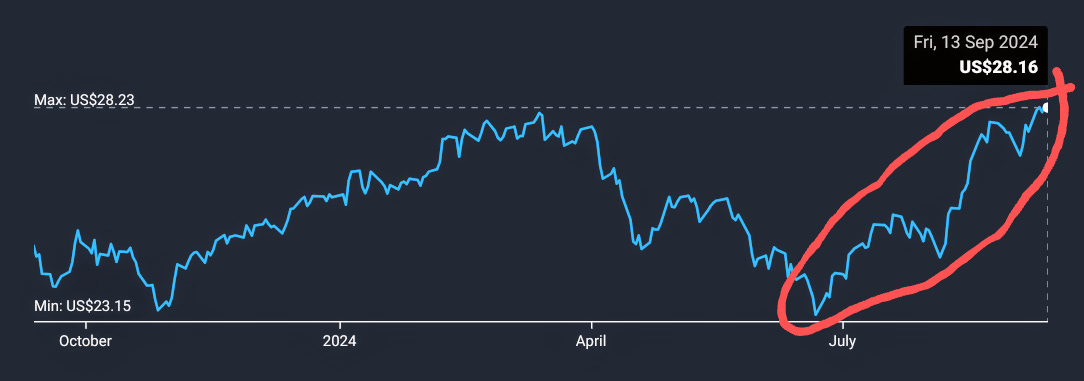

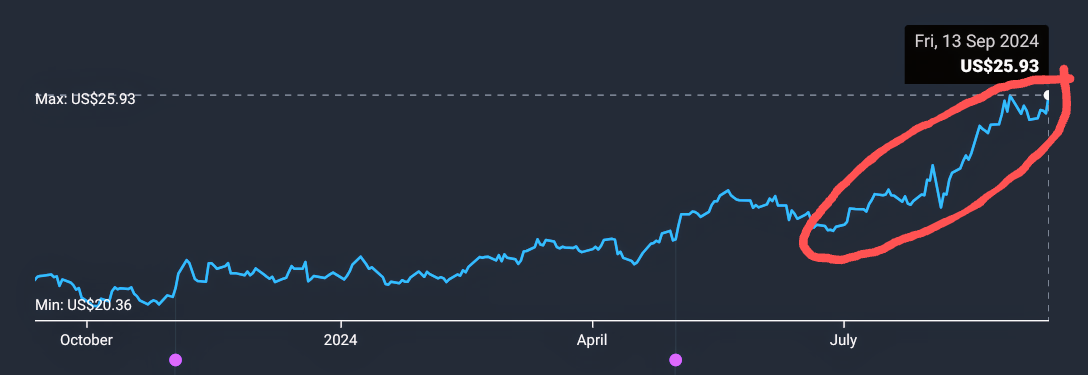

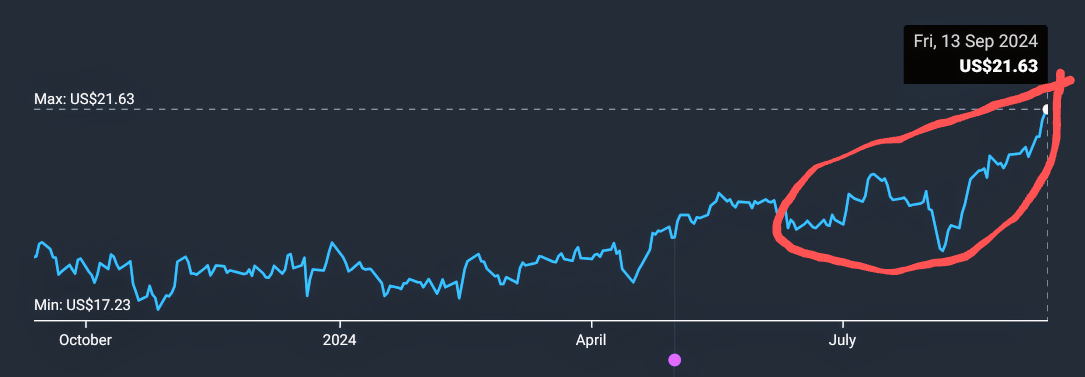

Five of the best-performing emerging markets exchange-traded funds (ETFs) in the last three months come from Southeast Asia, with Indonesia leading the way. Demand for their stocks is increasing, and, as a result, prices are rising. Lower interest rates will increase the present value of their companies’ future cash flows, making their stocks more valuable.

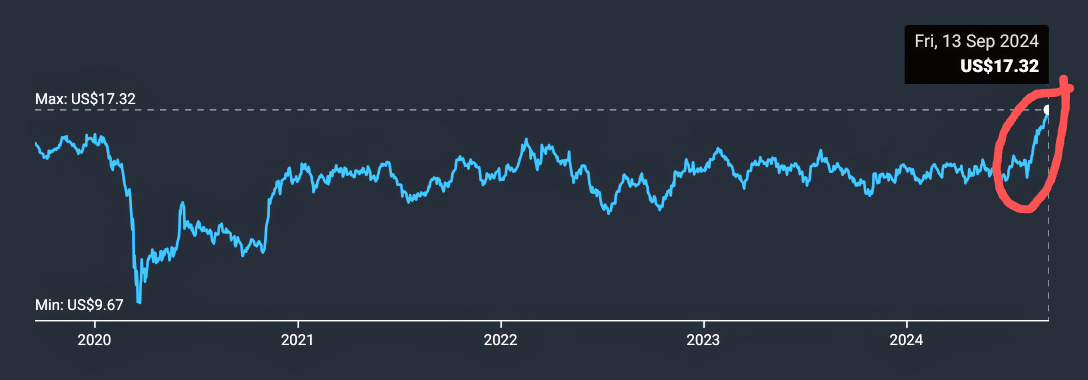

Foreign investments have surged, pushing the market values of Southeast Asia’s 40 largest companies to their highest level since April 2018.

Aside from falling interest rates, this growing interest in Southeast Asia, from Indonesia to Vietnam, is also due to a combination of factors: foreign investors still have relatively low investments here, local governments are supporting the market, and stocks are attractively priced. These factors make Southeast Asia appealing to global investors, especially as they pull back from larger markets like China, which is facing economic challenges.

“Southeast Asia has been overlooked for a long time,” said John Foo, founder of Valverde Investment Partners. “But now investors are noticing opportunities, whether it’s commodity companies in Indonesia, real estate in Singapore, tech firms in Malaysia, or exporters in Vietnam and Thailand.”

A big reason for this optimism is that foreign investors still have room to increase their holdings. Stocks in the Philippines, Thailand, and Indonesia are trading at cheaper prices than their three-year averages and the region’s six markets are cheaper compared to China and India.

Median market price to earnings ratios, ranked from cheapest to expensive, as of September 13, 2024:

Philippines: 9.3x (3-Year Average: 11.3x)

Singapore: 11.1x (3-Year Average: 11.8x)

Vietnam: 14.2x (3-Year Average: 13.4x)

Thailand: 15.1x (3-Year Average: 17.4x)

Malaysia: 15.3x (3-Year Average: 15x)

Indonesia: 15.8x (3-Year Average: 16.5x)

China: 26.5x (3-Year Average: 33.3x)

India: 34.5x (3-Year Average: 25x)

Local policies are also playing a role. Indonesia has introduced fiscal easing, and both Thailand and Malaysia are promoting stock ownership. Kenneth Tang, portfolio manager at Nikko AM Shenton Thrift Fund, noted that these countries benefit from sectors like banks and real estate, which do well in low-interest-rate environments.

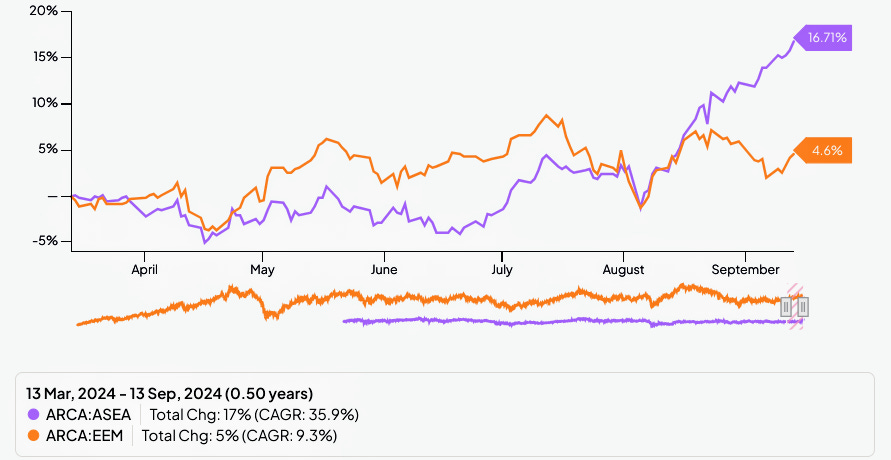

Thanks to these factors, Southeast Asia’s 40 largest companies have outperformed the emerging markets average by 12.1% over the past six months.

Investment banks and securities brokerages are paying attention. Goldman Sachs recently upgraded Thailand’s market rating, expecting the country’s new Vayupak Fund to attract foreign investment. Similarly, Nomura Holdings upgraded Malaysian and Indonesian stocks.

“If interest rate cuts continue and we avoid a recession, this rally could last until the end of 2025,” said Chun Hong Lee, portfolio manager at Principal Asset Management.

In sum, Southeast Asian stocks have emerged as a top choice for global investors, driven by expectations of falling US interest rates and attractive market conditions. With five of the best-performing emerging markets ETFs coming from this region — led by Indonesia, Thailand, and the Philippines — foreign inflows have surged, pushing the market values of Southeast Asia’s largest companies to their highest since 2018. Low foreign ownership, supportive local policies, and cheaper valuations compared to markets like China and India make the region even more appealing. As investors shift focus from larger economies facing challenges, Southeast Asia’s blend of growth potential and stability is capturing global attention, setting the stage for a sustained rally through 2025.

SeA (Southeast Asia) Focus Portfolio Update:

From its inception on December 22, 2023, to August 30, 2024, the portfolio, which invests in the highest-quality and fastest-growing businesses in Southeast Asia at attractive prices, delivered a total return of 36.4%, outperforming all Southeast Asian country index funds.

Follow the portfolio here.