Hotel101's U.S. Listing via JVSPAC: A Rare Asymmetric Opportunity for Global Investors

Investors could see returns of +38% to +84%.

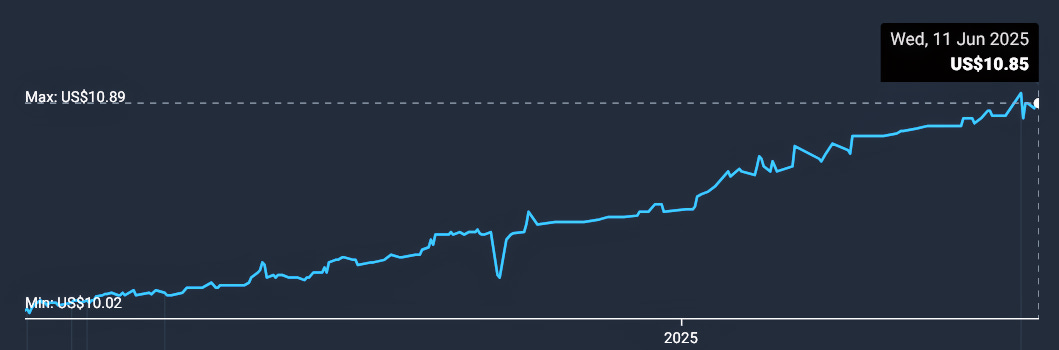

As of June 11, 2025, JVSPAC Acquisition Corp. (Nasdaq: JVSA) is trading at US$10.85 per share, reflecting a market capitalization of approximately US$83.4 million. For the casual observer, JVSA may appear to be yet another obscure special purpose acquisition company (SPAC) trading slightly above the standard US$10.00 net asset value. But a closer, deeper analysis reveals that JVSA is, in fact, a rare and asymmetric investment opportunity — one that connects investors around the world with a disruptive hospitality business that is weeks away from becoming the first-ever Filipino-owned company to list on Nasdaq under the new ticker HBNB.

This is no speculative penny stock or hyped meme vehicle. JVSA is the publicly listed SPAC that will soon merge with Hotel101 Global Pte. Ltd., a fast-scaling global hospitality brand backed by DoubleDragon Corporation, one of the Philippines’ most respected property developers. The two parties are executing a US$2.3 billion reverse merger transaction that, upon completion, will result in the combined company — Hotel101 Global Holdings Corp. — trading publicly on the Nasdaq under the ticker HBNB. JVSA shares will automatically convert into HBNB shares, likely on a 1-for-1 basis, preserving the shareholder’s equity interest in the new entity.

To understand why this is potentially a high-upside investment hiding in plain sight, let’s unpack what this transaction means for existing JVSA shareholders and why the current pricing of US$10.85 represents a unique window before value gets unlocked.

The Mechanics of Share Conversion: What Happens to JVSA Shares?

For non-finance readers, here’s the key idea: JVSA is essentially a “shell company” that raised money from investors to find and merge with a promising private business, which it has now found in Hotel101. When the deal completes, JVSA will disappear and be replaced by a newly listed company — HBNB — with real operations, assets, and revenues.

As a JVSA shareholder, you will not lose your shares. Instead, your JVSA shares will convert into HBNB shares automatically. Based on the public filings, this conversion will likely happen at a 1:1 ratio, meaning if you hold 1,000 JVSA shares, you’ll receive 1,000 HBNB shares after the merger is finalized. This is standard practice in SPAC transactions.

US$10.85 JVSA Price vs. US$10.00 Transaction Price: What Does That Tell Us?

In most SPAC deals, the “deal price” for the company being acquired (in this case, Hotel101) is based on a US$10.00 per share reference. This is the valuation anchor from which all share allocations, deal math, and capital structures are derived.

Yet JVSA is already trading at US$10.85, which is 8.5% higher than the standard US$10.00 SPAC trust value.

That premium tells us something important: the market is already assigning value to the upcoming merger with Hotel101. It is placing a premium on the certainty of deal completion and the perceived upside in HBNB’s future trading performance. The fact that shares are trading above trust value, this close to the merger, indicates investor confidence that this is not a deal that will collapse or fade into delay cycles — a common fate for many failed SPACs.

What’s remarkable is that despite this premium, JVSA is still priced at a steep discount to the implied valuation of the business it is merging with. Hotel101 is being valued at US$2.3 billion, yet JVSA’s current market cap is only US$83.4 million — barely 3.6% of the pro forma valuation of the combined company. Why? Because most of the shares (over 195 million HBNB shares) will be issued to the sellers (DoubleDragon and affiliates), and JVSA’s public float remains small. But this discrepancy between current market cap and the size, scope, and valuation of the merged business is what creates the opportunity.

Hotel101: A Scalable Global Platform

Hotel101 is not your typical local hotel chain. It is a technology-forward hospitality platform built for rapid scalability. Think of it as the “Toyota Corolla” of hotel rooms — standardized, predictable, and cost-efficient. From Manila to Madrid to Mexico City, Hotel101 aims to sell the exact same room configuration, under the same model, using an app-driven digital sales platform. This standardization enables superior margins, faster build times, and easier cross-border expansion compared to traditional hospitality chains burdened by legacy systems and inconsistent operations.

This model is capable of global rollout at scale, with room inventory monetized not just by nightly stays, but also by pre-selling units to real estate investors — blending hospitality with fractional property ownership, similar to Marriott’s timeshare business. The addressable market is massive. And unlike speculative tech startups, this is a business with real cash flows, tangible assets, and a proven development pipeline already underway in Asia, the Middle East, and Europe.

What Happens After the Merger: Trading as HBNB

Once the merger is completed (JVPAC can extend its merger deadline up to July 2026), the combined company will begin trading under the ticker HBNB on the Nasdaq. Your converted shares will now be called “HBNB Ordinary Shares” and will trade freely on the open market like any other stock.

The initial trading price of HBNB shares could vary. While the transaction values shares at US$10.00, the market could open HBNB at a higher or lower price depending on investor sentiment, market conditions, and demand for a new global hospitality brand with an Asian growth narrative. Historically, well-received post-SPAC companies have opened anywhere from US$12 to US$20+ per share, while poorly received ones can fall below US$10. But with Hotel101’s solid fundamentals, unique global footprint, and first-mover narrative (first Filipino Nasdaq listing), the upside scenario is tangible and exciting.

Asymmetric Upside, Limited Downside

This is where the asymmetric profile becomes clear. Buying JVSA at US$10.85 gives investors:

Exposure to a US$2.3 billion business at a fraction of its valuation

Automatic conversion into HBNB shares with no extra action needed

Global listing exposure on Nasdaq

The potential for share price appreciation post-merger as the story gains traction

Yes, you are paying a small premium over US$10.00, but the potential upside of the HBNB listing vastly outweighs this modest cost. In a bullish scenario, if HBNB trades at US$15.00 to US$20.00 in the months after listing (as some SPACs with compelling stories have done), investors at US$10.85 could see returns of +38% to +84%, without leveraging options or taking on debt.

The downside? If the merger collapses (which is unlikely given the SEC already approved the F-4), JVSA shares would likely revert to near-net-asset value (~US$10.00), implying a modest -7.8% loss from current prices. Not riskless — but highly skewed in favor of long-term upside.

Final Thought: A Rare Chance at the Ground Floor

In a world where most investors only hear about game-changing listings after the fact, JVSA offers a transparent, legal, and relatively low-risk way to get in before Hotel101 goes live on Nasdaq. Unlike hype-fueled SPACs built around buzzwords, this is a real business, with real rooms, backed by a serious founder (Edgar “Injap” Sia) with a track record of building billion-dollar businesses (e.g., Mang Inasal, now part of Jollibee Foods).

At US$10.85, JVSA offers more than just arbitrage. It is a front-row seat to the transformation of a regional hospitality firm into a global hotel-tech brand — and possibly, the birth of the next Marriott or Hilton, but with a Southeast Asian soul.

For those willing to look past the noise, do the homework, and act with conviction, this may be one of those rare pre-merger SPAC moments that actually deliver on the original promise of democratizing IPO access.