Rice Boom: Vietnam’s Exports Hit Highest Prices Worldwide, Driving Economic Growth

As a result of growing global demand outstripping supply, Vietnam is projected to export between 7.4 and 8 million tons of rice in 2024, with expected revenues surpassing US$5 billion.

Dear partners and investors,

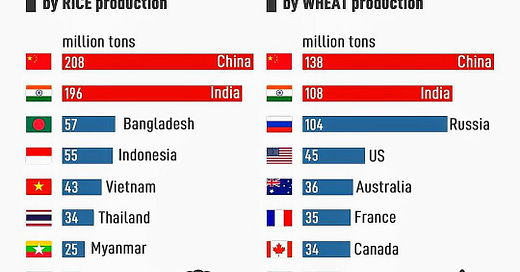

Vietnam’s rice export prices have surged to the highest levels globally, surpassing those of major competitors like Thailand and Pakistan, according to the Vietnam Food Association (VFA). This remarkable price increase positions Vietnam as a continuing leader in the global rice market, showcasing its significant role in driving the country’s economic growth.

Specifically, Vietnam’s 5% broken rice is now trading at an impressive US$575 per ton, outpacing Thailand by US$14 and Pakistan by US$34 per ton. Similarly, the price of the country’s 25% broken rice has climbed to US$539 per ton, eclipsing comparable products from Thailand and Pakistan by US$27 and US$22 per ton, respectively.

This pricing dominance marks a significant turnaround for Vietnam, especially considering that just last month, its export prices lagged behind those of Thailand, Pakistan, and Myanmar. The VFA attributes this sharp increase to a global supply-demand imbalance, where demand is outstripping supply as many rice-producing nations have concluded their main harvest seasons.

Adding to this favorable landscape, the Philippines, one of Vietnam’s largest rice importers, has slashed its rice import tax from 35% to 15%, prompting an increase in imports from Vietnamese suppliers. Vietnam’s rice export prices have also seen substantial gains in non-traditional markets such as Brunei and the U.S., where prices have soared to US$959 and US$868 per ton, respectively.

VFA statistics reveal that Vietnam exported nearly 5.3 million tons of rice, generating approximately US$3.34 billion in the first seven months of this year. Although the export volume grew by just 8.3%, the export value skyrocketed by 27.7% compared to the same period last year.

The Ministry of Agriculture and Rural Development (MARD) anticipates that global demand for rice will continue to rise in the coming months, leading to a robust export market through the end of the year. Notably, the Philippines has revised its rice import forecast upwards, now expecting to import 4.5 million tons, up from the previously projected 3.6 million tons for 2024.

As a result of this growing global demand, Vietnam is projected to export between 7.4 and 8 million tons of rice in 2024, with expected revenues surpassing US$5 billion. This trend not only highlights Vietnam’s strategic importance in the global rice trade but also underscores the sector’s critical contribution to the nation’s economic prosperity.

How has Vietnam’s agricultural industry performed?

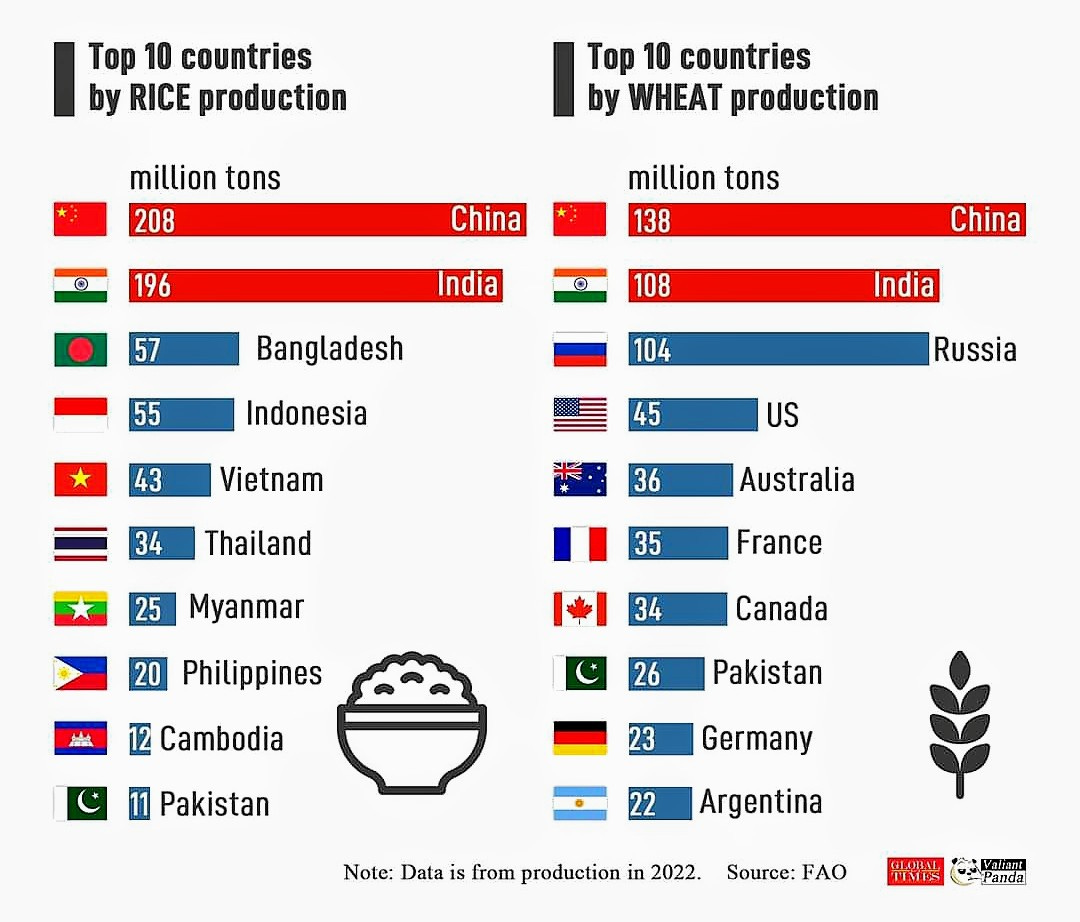

Over the past year, the stock prices in Vietnam’s agricultural industry have increased by 11.5%. Investors are feeling positive about the industry’s future and believe in its long-term growth. Currently, the industry is trading at a price-to-earnings (PE) ratio of 21.3x, which is much higher than its 3-year average PE of 0.81x. Over the past three years, the industry’s earnings have grown by 33% each year.

What does this mean for investors?

Vietnam’s surging rice export prices, increasing export volumes, and rising global demand signal strong growth potential in the agricultural sector. Coupled with rising industry stock prices and earnings, this creates a favorable investment environment, promising robust returns and long-term profitability as Vietnam solidifies its position as a key player in the global rice market.

I wish you superior returns on your capital.

Eric, The International Investor

SeA (Southeast Asia) Focus Portfolio Update:

From its inception on December 22, 2023, to August 23, 2024, the portfolio delivered a total return of 36%, outperforming all Southeast Asian country index funds.

Follow the portfolio here.