Southeast Asia Market Insights: Understanding Investor Sentiment and Growth Potential in ASEAN Inc.

July 11, 2025 Edition

Executive Summary

This investment report offers a comprehensive snapshot of the Southeast Asian market through a unique conceptual lens: ASEAN Inc. — a fictional holding company that represents the collective economic performance of six Southeast Asian countries. Each “subsidiary” of ASEAN Inc. is symbolized by a country-specific exchange-traded fund (ETF) traded in the U.S., allowing international investors to gain exposure to these rapidly developing markets.

We examine ASEAN Inc.’s performance since inception on December 31, 2024, and dissect the interplay between market returns, earnings forecasts, dividend income, valuation metrics, and sector trends. While the company as a whole has returned +7.2% (an annualized return of +14.1%) by July 11, 2025, the real story lies beneath the surface: in the divergence between investor sentiment and analyst expectations, and in the long-term earnings potential that remains largely untapped across many markets.

For non-finance readers, we explain concepts such as ETFs, valuation ratios, earnings growth, and dividend yields to offer a clear understanding of where each ASEAN market stands, and what that could mean for future investment decisions.

Introducing ASEAN Inc.: A Thought Experiment in Regional Exposure

Imagine ASEAN Inc. as a conglomerate of seven businesses, each headquartered in one of Southeast Asia’s most dynamic economies: Vietnam, Singapore, the Philippines, Malaysia, Indonesia, Thailand, and a composite ETF representing ASEAN’s 40 largest companies. This framework allows investors to view the region as a unified portfolio, where performance, growth, and valuations can be assessed collectively and individually.

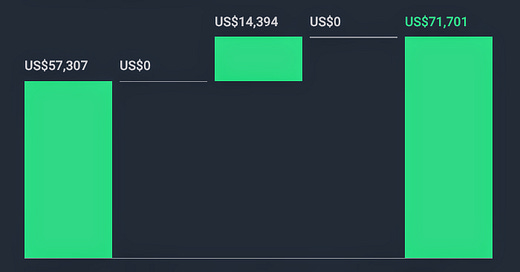

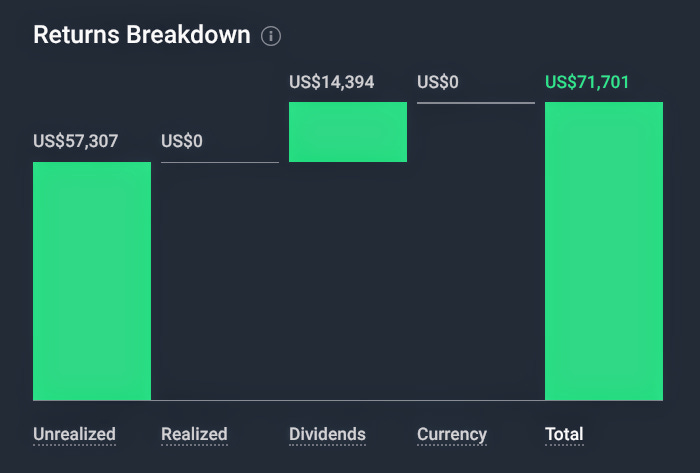

From its inception on December 31, 2024, to July 11, 2025, ASEAN Inc. delivered a total return of +7.2%, or US$71,701, comprised of +5.7%, or US$57,307, in price appreciation and +1.4%, or US$14,394, from dividends. This translates to an annualized return of +14.1%, a solid performance in any global context.

The market value of the hypothetical ASEAN Inc. portfolio has grown from US$1 million to US$1,057,304 in just over six months.

Performance Review: The Winners and Laggards

Not all ASEAN markets performed equally. Here are the total returns for each country ETF, including dividends:

Vietnam: +27.3%

Singapore: +22.2%

Philippines: +9.7%

ASEAN Top 40 ETF: +3.6%

Malaysia: +0.2%

Indonesia: -0.7%

Thailand: -12.2%

Vietnam and Singapore clearly surged ahead, driven by strong investor sentiment and market momentum. Meanwhile, Thailand lagged sharply, reflecting investor pessimism despite relatively healthy earnings forecasts.

Yet, as legendary investors like Warren Buffett and Peter Lynch remind us, short-term prices often diverge from business fundamentals. Over time, stock prices follow earnings growth — and it is in this light that the true potential of ASEAN Inc. must be assessed.

Forecasting Growth: Where Analysts See the Most Upside

According to consensus estimates, ASEAN Inc.’s collective average annual earnings growth over the next three years is +12.8%. This figure is central to estimating long-term investment returns. Here’s the breakdown by market:

Indonesia: +26.1%

Vietnam: +12.7%

Thailand: +11.4%

Philippines: +10.9%

Malaysia: +8.5%

Singapore: +7.2%

These numbers indicate that while Indonesia may have posted negative recent returns, its forward-looking earnings potential is the highest — a potential disconnect that may represent a value opportunity.

Dividend Yield-on-Cost: An Income Perspective

In addition to capital gains, dividends form an essential part of total return. The dividend yield-on-cost — which compares current dividend income to the original investment — provides insight into future income potential. ASEAN Inc.’s blended dividend yield-on-cost stands at 3.3%, bringing the expected annual return over the next three years to +16.1% (earnings growth + dividend yield).

Here's how each country stacks up in terms of dividend yield-on-cost:

Singapore: 4.8%

Indonesia: 4.2%

Malaysia: 3.9%

Thailand: 3.2%

Philippines: 2.2%

Vietnam: 1.2%

Combining earnings growth and dividends, the total expected annual return over the next three years for each market is as follows:

Indonesia: +30.3%

Thailand: +14.6%

Vietnam: +13.9%

Philippines: +13.1%

Malaysia: +12.4%

Singapore: +12.0%

This analysis suggests Indonesia offers the highest forward-looking total return, despite its current underperformance — an intriguing opportunity for contrarian investors.

Valuations: A Measure of Market Sentiment

The price-to-earnings (P/E) ratio is a commonly used metric to determine whether a market is overvalued, fairly valued, or undervalued. It compares a company’s (or in this case, a country’s) stock price to its earnings per share. When compared to historical averages, we can derive insights into whether investors are paying a premium or discount for expected growth.

Indonesia: 19.3x (Above 3-Year Average of 18.7x) – Overvalued

Malaysia: 16.2x (Below 3-Year Average of 17.1x) – Undervalued

Philippines: 11.6x (Below 3-Year Average of 12.5x) – Undervalued

Singapore: 15.0x (Above 3-Year Average of 13.7x) – Overvalued

Thailand: 15.2x (Below 3-Year Average of 18.2x) – Undervalued

Vietnam: 14.7x (Slightly Above 3-Year Average of 14.4x) – Fairly Valued

These valuations reveal some inconsistencies. For example, Indonesia’s strong earnings outlook is already priced in, while Thailand’s low valuation contrasts sharply with its solid growth prospects, suggesting it may be overlooked.

Sectoral Insights: Where the Growth Is Happening

Investor attention often gravitates toward sectors with the most near-term excitement, but analyst forecasts can reveal where sustainable growth may truly lie. Here’s how those perspectives differ:

Sectors Currently Favored by Investors (Based on Fund Flows and Momentum):

Indonesia: Technology (+8.9% forecasted annual growth)

Malaysia: Technology (+20.2%)

Philippines: Consumer Discretionary (+18.2%)

Singapore: Real Estate (+14.3%)

Thailand: Technology (+12.8%)

Vietnam: Consumer Discretionary (+19.7%)

Sectors Analysts Are Most Optimistic About (Based on Forecasts for the Next Five Years):

Indonesia: Materials (+62.8% forecasted annual growth)

Malaysia: Consumer Discretionary (+21.4%)

Philippines: Materials (+21.3%)

Singapore: Healthcare (+28.6%)

Thailand: Materials (+49.4%)

Vietnam: Materials (+20.0%)

These insights reveal a critical distinction: investors are currently favoring tech and consumer sectors, but analysts foresee explosive growth in materials and healthcare. The divergence highlights potential opportunities for forward-thinking investors willing to look beyond current trends.

Conclusion: What Lies Ahead for ASEAN Inc.?

ASEAN Inc. is more than a hypothetical model — it reflects the combined economic dynamism, demographic tailwinds, and capital market potential of Southeast Asia. In the short term, investor sentiment is driving market returns unevenly across countries, with Vietnam and Singapore standing out. However, over the long term, fundamentals such as earnings growth and dividends will dictate true returns.

The data suggest that Indonesia, Vietnam, and the Philippines are poised for robust multi-year performance, despite mixed short-term investor enthusiasm. Meanwhile, undervalued markets like Thailand and Malaysia offer attractive entry points for value-oriented investors.

For investors seeking long-term exposure to emerging markets, ASEAN Inc. — and by extension, its constituent ETFs — presents a compelling mix of growth, income, and diversification. As the region continues to develop and integrate economically, the ASEAN story is just beginning to unfold.