The Historic Crypto Bubble, Part 2

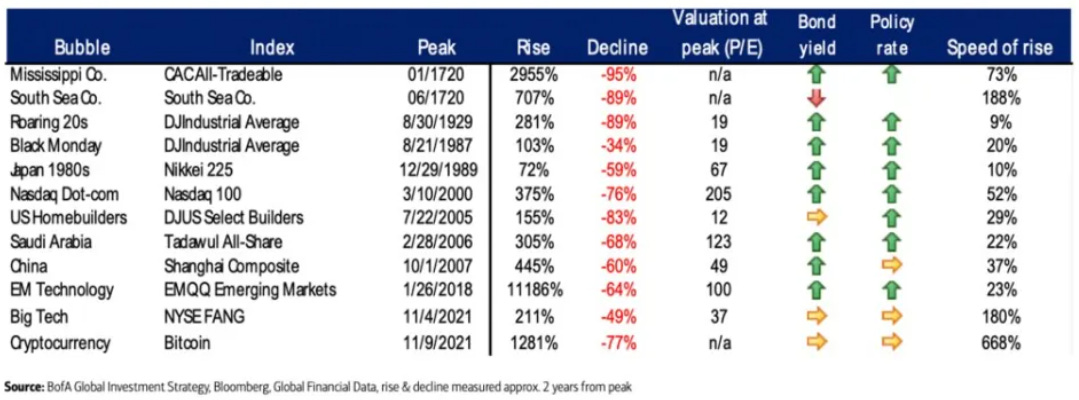

Bitcoin had the fastest rise (+668%), the third highest rise (+1,281%), and fifth largest crash (-77%) of all time!

“Since time immemorial, the financial markets of the world have been prone to bubbles in everything from tulips and art, to shares and houses. Therefore, obviously, it is very important for investors to understand them. All bubbles start as powerful fundamental developments and legitimate investment opportunities. They become bubbles, or manias, or whatever you want to call them, when investors, in their euphoric optimism, project future results, not based on rational fundamentals, but on continuation of past results.”

— Barton Biggs (Generated an overall return of 133% over eight years and outperformed the S&P 500’s return of 19% over the same period. Accurately predicted the dot-com bubble in the late 1990s.)

***

“Once a price history develops that causes people to start looking at an asset that they never looked at before, and to get envious of the fact that their neighbor made a lot of money, without any apparent effort, because he saw this early, and so on, that takes over.”

— Warren Buffett (Generated an annualized return of 20.1% over the past 57 years. Berkshire’s overall gain of 3,641,613% from 1964 to 2021 outperformed the S&P 500’s overall gain (including dividends) of 30,209%.)

***

“When a bubble finally bursts, the so-called fallacy of composition comes into play and inflames mob psychology. This theorem says that, in a crisis, the action that is rational for each individual is irrational for the group as a whole, and creates a disastrous outcome.”

— Barton Biggs

***

“I would be reluctant to think that men will ever be smart and far-sighted enough to avoid the next bubble unless man's basic greed can be excised. We know wars are not good, but they seem to be a permanent staple of humanity. Why not bubbles?”

— Paul Tudor Jones (The Tudor Futures Fund generated an annualized return of 27.2% from 1984 to 2010, and never had a loss.)

***

“A good working knowledge of the history of bubbles can also help preserve your capital.”

— James Montier (Finance behaviorist)

Read Part 1 of The Historic Crypto Bubble here.

The best way to protect ourselves from economic and geopolitical uncertainty (including bubbles) is to invest in high quality, cash generating businesses over the long term, that deliver real value to the economies they serve.

The International Investor provides profitable investment intelligence and manages a hedge fund for a select group of individuals, their families, and the foundations and companies they lead. The fund invests in the world’s highest quality businesses, with high and sustainable returns on capital, at attractive prices and margins of safety to what they're intrinsically worth. The fund compounds superior value over time, with minimum risk, regardless of the global market environment.

The content is for informational purposes only and is neither an offer to buy or sell securities nor investment advice. Forward-looking statements may be uncertain and historical returns may not predict future performance. The International Investor is not a registered broker-dealer, investment adviser, or fiduciary.