Week 10 of 2025 was nothing short of electrifying for investors. Hong Kong’s CK Hutchison Holdings and Mixue Group, and Europe’s Eutelsat Group saw their share prices skyrocket, fueled by game-changing deals, fast-food dominance, and geopolitical shifts. But the excitement didn’t stop there — Six businesses across Southeast Asia erupted, with their stocks posting massive double-digit gains. Let’s break down these winners and what’s fueling this market madness.

CK Hutchison Holdings - The Panama Power Play

CK Hutchison’s stock surged 27.4% after announcing the sale of a majority stake in its US$22.8 billion ports business to a BlackRock-led consortium. The ports, including key holdings along the Panama Canal, are vital trade arteries. With the U.S. government backing the deal, investors saw this as a major power move that cements CK Hutchison’s long-term profitability (and its geopolitical sanity).

Adding to the optimism, analysts forecast CK Hutchison’s revenue to grow 14.9% annually over the next five years, reaching HK$558 billion. Despite this strong outlook, the stock remains 15.1% undervalued, making it an attractive buy for long-term investors.

Fun Fact: Ever wondered why CK Hutchison’s stock ticker is simply “1”? The company’s roots trace back to Hutchison Whampoa, one of Hong Kong’s oldest and most powerful conglomerates (think James Clavell’s Tai-Pan). When stock tickers were first assigned, getting “1” was a symbol of dominance — and CK Hutchison still carries that prestige today.

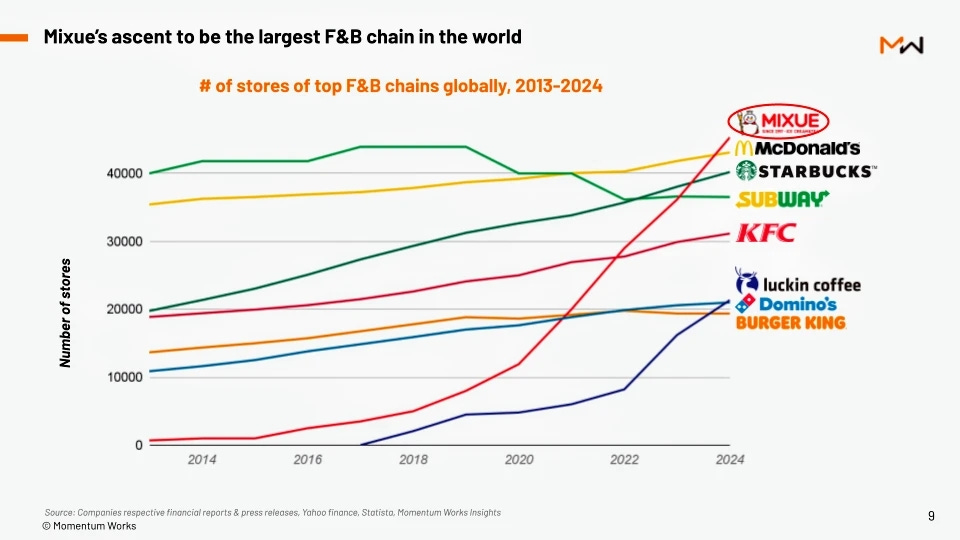

Mixue Group - The New King of Fast Food

Move over, McDonald’s and Starbucks — a new global fast-food empire has arrived! Mixue, the Chinese multinational known for budget-friendly ice cream and tea-based drinks, made an explosive debut on the Hong Kong Stock Exchange, with shares rocketing 47% on day one. But here’s the real shocker — Mixue is now officially the world’s largest fast-food chain, surpassing both McDonald’s and Starbucks in store count, with over 46,000 locations across Asia and Australia.

This unprecedented expansion proves that affordable, high-quality drinks and desserts are a winning formula. If Mixue keeps up its 29.6% annual revenue growth, it could reach CN¥86.2 billion in five years, making its stock 59.1% undervalued — a golden opportunity for investors betting on its continued global dominance.

Fun Fact: Despite its massive success, Mixue is still completely unknown in the U.S. and Europe — but not for long! The company is quietly making plans to crack the Western market, aiming to introduce its ultra-affordable treats to entirely new audiences. Could it be the America’s next fast-food sensation? Stay tuned.

Eutelsat Group - Europe’s Answer to Starlink?

Eutelsat’s stock went absolutely parabolic, soaring 554% in just three days! The catalyst? Speculation that the European Union wants Eutelsat to replace Elon Musk’s Starlink for Ukraine’s battlefield communications. With rising geopolitical tensions, Europe is scrambling for a homegrown alternative, and Eutelsat — already operating thousands of terminals in Ukraine — is stepping up. However, to fully replace Starlink, it needs to scale up at lightning speed.

This triggered a “Gamestop effect”, as retail traders piled in, sending the stock to the moon, squeezing short sellers. But can Eutelsat deliver? CEO Eva Berneke is confident, promising thousands more terminals in the coming months.

Despite the hype, analysts predict Eutelsat’s revenue to grow at a steady and boring 5.5% annually over the next five years, reaching €1.6 billion, and will remain unprofitable until then. The stock is currently 90.7% overvalued and a correction may have already started, meaning the retail frenzy may be cooling down.

Fun Fact: Eutelsat operates some of the most powerful satellites in the world, including one capable of beaming the internet directly to Antarctica. That means even researchers at the South Pole can stream their favorite shows — provided they’re not too busy studying glaciers!

Southeast Asia’s Market Madness - Even More Stocks on Fire!

If those surges weren’t enough, six stocks across Southeast Asia also erupted over the past week, fueled by strong 2024 earnings reports. Check out these massive moves:

Thailand’s Stecon Group skyrocketed 59.9%, driven by booming construction demand.

Indonesia’s Suryamas Dutamakmur surged 58.7%, thanks to a red-hot real estate market.

The Philippine National Bank jumped 25.9%, celebrating record-breaking profits.

Malaysia’s D & O Green Technologies climbed 20.9%, boosted by strong semiconductor demand.

Singapore’s Hong Leong Asia gained 15.8%, benefiting from industrial growth and recovery.

Vietnam’s Vingroup rose 10%, fueled by optimism in real estate and EV expansion.

This explosive market action proves one thing — Southeast Asia’s growth story is alive and kicking. Whether it’s infrastructure, finance, real estate, or clean energy, investors are piling in, betting big on the region’s future.

The Takeaway

Week 10 of 2025 was a rollercoaster ride, with massive share price movements fueled by global power plays, industry disruptions, and meme-stock-style speculation. If this week taught investors anything, it’s that the markets never fail to surprise — and that there are many opportunities, if you know how to dig and value. The question now is: Who’s next in line for a breakout? Stay sharp — because in this market, anything can happen.